Harris Wholesale Grocery Company has gross sales per year of $7 million and grants credit terms to its customers of 2/5. net 15 As a result. 60% of customers pay on the discount date 20% pay on the net due date, and 20% pay on average 10 days after the due date Assuming that sales are uniform throughout the year and using a 360-day year In the calculation what is the approximate annual amount of discount that Hams customers are allowed to take?

Assuming mere are no other imitations, should AMI accept the one-time order from a financial perspective? Explain your answer

Essay

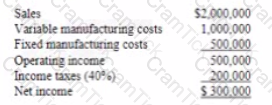

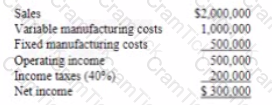

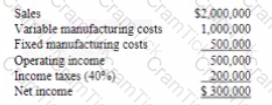

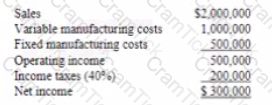

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Identify the market structure in which OLI operates and explain how OLi's pricing is affected by this mantel structure

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

Explain me concept of relevant cost in the season-making process and discuss whatever the €200, 000 course development coil is relevant to OLi's price decisions in future years

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

Calculate Guda’s marginal cost of capital- Show your calculations.

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Discuss whether QDD stock provided a return that was Better, worse, or the same as its investors would have expected using CAPM snow your calculations

Essay

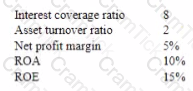

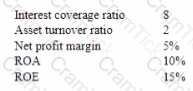

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

An accountant is employed in the financial reporting department of a publicly-traded company. The company s compensation plan includes a year-end bonus based on the entity's financial performance and stock option rewards based on individual performance Using iMAs Statement of Ethical Professional Practice, identify the ethical Issues, if any, that may Be presented by this company s compensation plan.

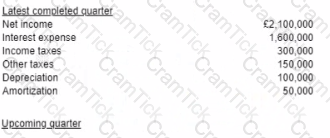

LMN Ltd, a British firm, has a financial covenant with its bank mat interest coverage based on earnings before interest taxes, depreciation, and amortization (EBITDA), must be at least 2.5 for each quarter Shown below are summary financial data.

An expected decline m sales will result In net Income of £ 1.500.000 The other elements of EBITDA will be similar to the most recently completed Quarter Given the above information, what is the ratio for the latest completed quarter and do the forecasted results meet the required covenant?

When evaluating a capital Budgeting proposal, an advantage of using the payback method is that Bits process

How many units should be produced and sow it AMI'S target net income is $600,000? Snow your calculations.

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

According to the IMA Statement of Ethical Professional Practice, identify and explain the standard(s) that Matthew would violate if he chooses not to report the issue regarding the accounting manager.

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Explain one reason each Tot and against issuing bonds with a call feature

Essay

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Explain why facilitating payments can create possible ethical and legal issues tor a company

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.