A stock has a dividend per share of $5 and is expected to grow at a constant rate of 3% indefinitely. The required rate of return is 9%.

What is the value of the stock?

Alliah Company produces vaccines at its pharmaceutical facility near a river. It is considering expanding its operations by building a second facility next to the first. The company holds a public hearing to discuss an extra investment it will make to minimize pollution and keep the river clean and thriving for the native wildlife.

How does this effort support the overall goal of the firm?

Why might a firm use a combination of methods to calculate the cost of common equity?

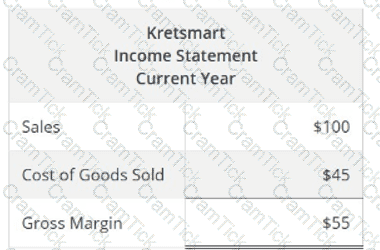

Kretsmart anticipates its sales will grow by10% each year for the next two years. Information from the company’s current income statement is given below, andCost of Goods Sold (COGS) is assumed to be a spontaneous account.

What would the company’sprojected gross margin for Year 2?

Which requirement does the Sarbanes–Oxley Act (SOX) impose on company executives?

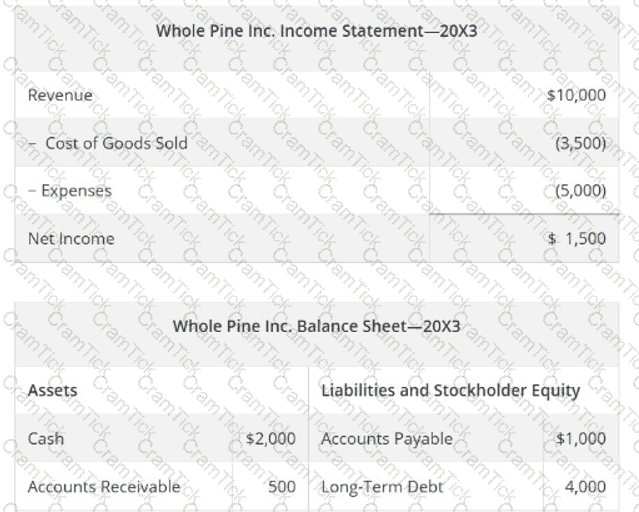

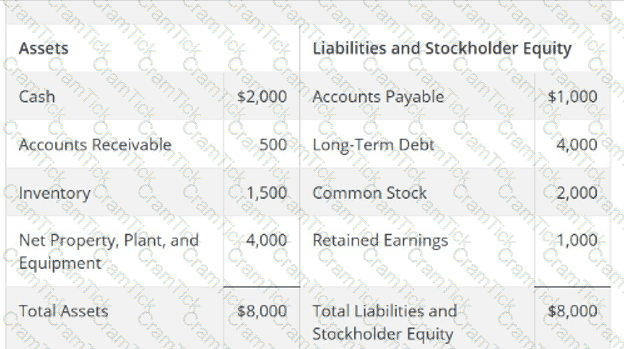

Use Whole Pine Inc.’s financial statements for 20X3 below to answer the following question.

What is Whole Pine Inc.’stotal asset turnoverfor 20X3?

A company has a return on assets (ROA) of 10% and total assets of $500 million.

What is its net income?

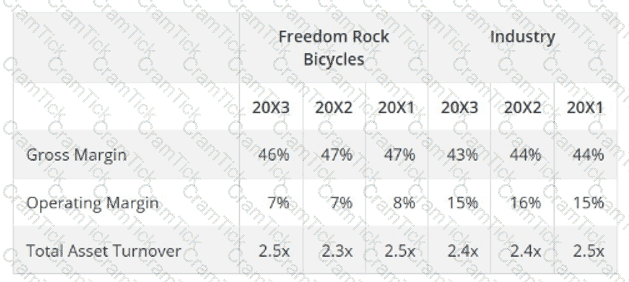

Ratios for Freedom Rock Bicycles are shown below, along with industry average ratios.

What are appropriate recommendations for Freedom Rock Bicycles based on this analysis?

Rusty RoboTech, a robotics technology company, has provided the following financial information for the year 20X3:

• Sales Revenue: $500,000

• Net Income: $50,000

• Dividend Payout: 40% of Net Income

• Total Assets at the beginning of 20X3: $300,000

• Total Liabilities at the beginning of 20X3: $150,000

• Equity at the beginning of 20X3: $150,000

• Historical Cash-to-Sales Ratio: 5%

• Accounts Receivable-to-Sales Ratio: 15%

• Inventory-to-Sales Ratio: 25%

• Cost of Goods Sold-to-Sales Ratio: 43%

For the year 20X4, Rusty RoboTech projects a 20% increase in sales revenue. Other ratios and the dividend policy are expected to remain the same.

What is the projected inventory value for Rusty RoboTech at the beginning of 20X4?

What is the main responsibility of the Financial Industry Regulatory Authority (FINRA)?

What is an advantage of using the Gordon growth model to estimate the cost of common equity?

A building owner is undertaking a weatherization project. The owner will make a one-time investment of $410,000 for caulking, sunshades, and smart thermostats. Annual utility savings are projected to be:

Year 1: $125,000

Year 2: $125,000

Year 3: $140,000

Year 4: $140,000

Year 5: $160,000

What is thepayback period, in years?(Round up)