You need to determine why CustomerX is unable to confirm another sales order.

What are two possible reasons? Each answer is a complete solution.

NOTE: Each correct selection is worth one point.

You need to troubleshoot the reporting issue for User7.

Why are some transactions being excluded?

You need to correct the sales tax setup to resolve User5's issue.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

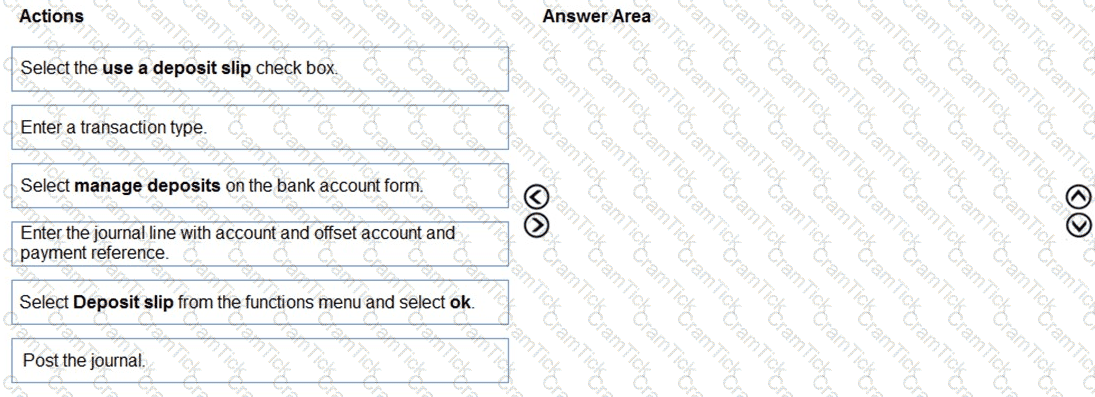

You need to assist User3 with generating a deposit slip to meet Fourth Coffee's requirement.

Which five actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

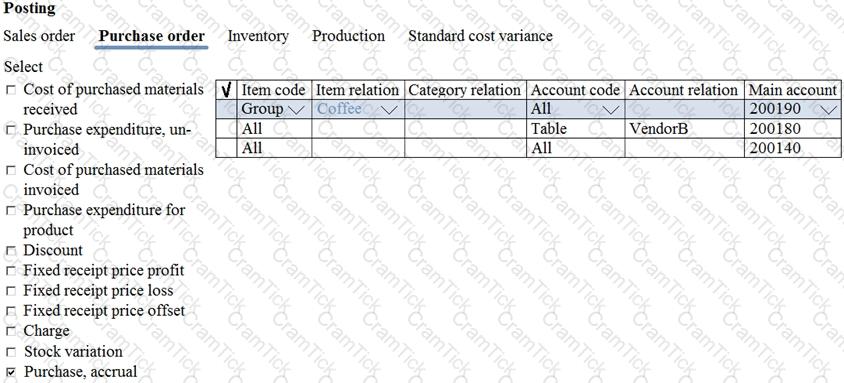

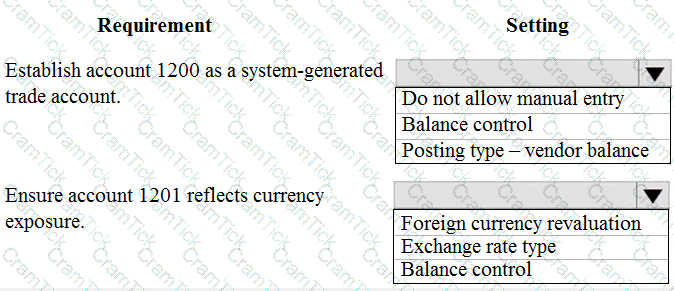

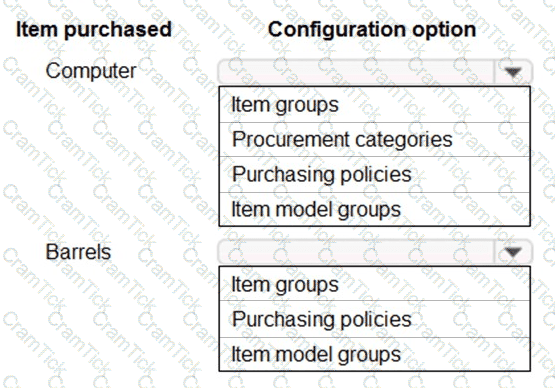

The posting configuration for a purchase order is shown as follows:

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

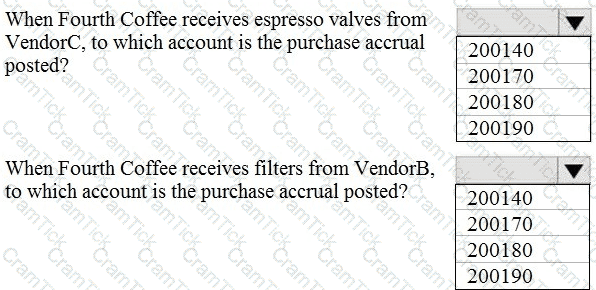

You need to configure settings to resolve User1’s issue.

Which settings should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to ensure that User9's purchase is appropriately recorded.

Which three steps should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to view the results of Fourth Coffee Holding Company's consolidation.

D18912E1457D5D1DDCBD40AB3BF70D5D

Which three places show the results of financial consolidation? Each correct answer presents a complete

solution.

NOTE: Each correct selection is worth one point.

A company implements Dynamics 365 Finance. The company uses a third party to provide support services.

You need to configure a payment method to allow the company to reimburse any expenses reported by the third-party service provider.

Which two methods should you use? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

A company uses Dynamics 365 Finance.

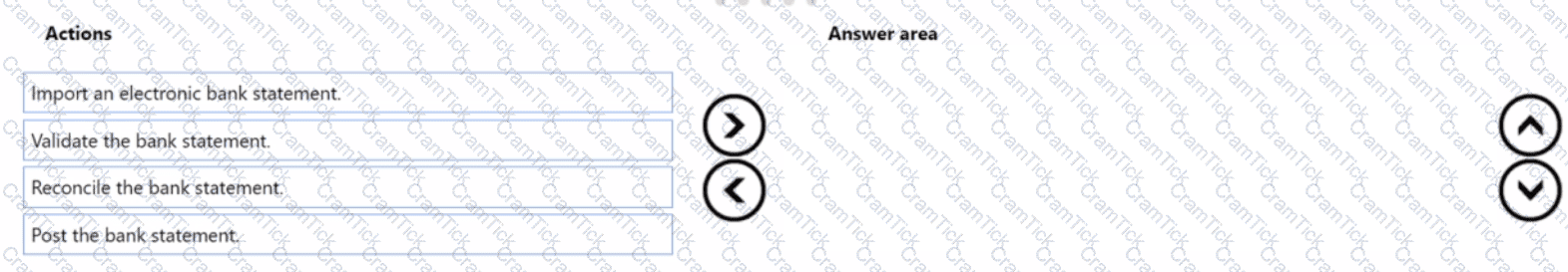

You need to use the advanced bank reconciliation feature to reconcile bank transactions.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

A company uses Dynamics 365 Finance for its recurring contract billing.

The company bills its customers a one-time fee when customers first set up services. The company bills customers a minimum charge plus actual usage based on tiered pricing.

The company configures service items for fees, minimum charges, and usage with the sales price in released product along with the trade agreement for the pricing.

The company must be able to manage pricing through trade agreements and released product sales price.

You need to configure the billing schedule line for each service item.

How should you complete the setup? To answer, move the appropriate pricing methods to the correct billing schedule lines. You may use each pricing method once, more than once, or not at all. You may need to move the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution. Determine whether the solution meets the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance.

The controller notices incorrect postings to the ledger entered via journal.

The system must enforce the following:

Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional.

Revenue accounts (4000-4999) require department and division and allow project and customer dimensions.

Liability accounts (2000-2999) should not have any dimensions posted.

Expense account (6999) requires department, division, project and customer dimensions with all transactions.

You need to configure the account structure to meet the requirements.

Solution:

Configure two account structures: one for liability accounts listing the (2000-2999) range with no following dimensions and one for Expense and Revenue accounts.

For Expense accounts (6000-6998) and Revenue accounts (4000-4999), configure asterisks in all dimension columns.

For Expense account (6999), configure asterisks in all dimensions. Configure an asterisk and quotes in the customer dimension.

Does the solution meet the goal?

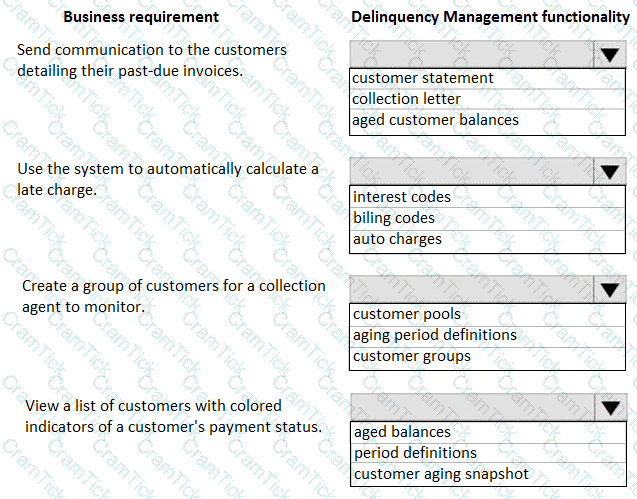

A company has delinquent customers.

You need to configure Dynamics 365 for Finance and Operations to meet the following requirements:

• Send communication to the customers detailing their past-due invoices.

• Use the system to automatically calculate a late charges,

• Create a group of customers for a collection agent to monitor.

• View a list of customers with colored indicators of a customer's payment status.

You need to associate the correct system functionality to manage delinquent customers based on these business requirements.

A company plans to implement basic budgeting functionality in Dynamics 365 Finance. You need to configure the minimum number of components to enable functionality. Which three required components should you configure? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

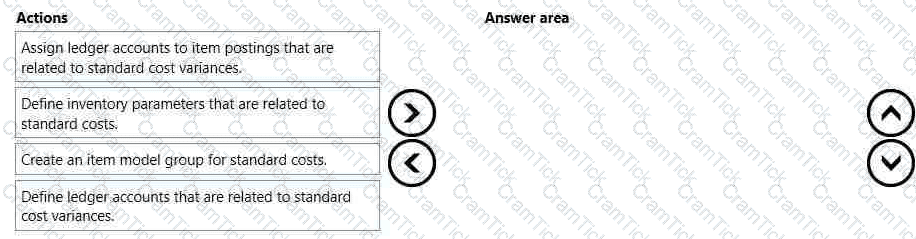

You need to setup a process of tracking, recording, and analyzing costs associated with the products or activities of a nonmanufacturing organization.

You need to configure the prerequisite setup for the standard costing version for the current period.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

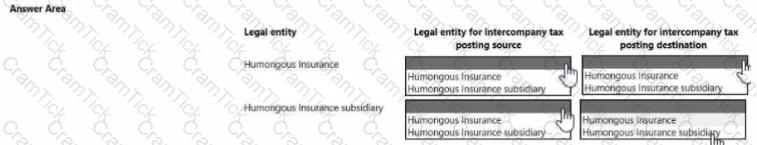

A consulting organization with multiple legal entities is using Dynamics 365 Finance for expense management. The company has all workers under a single legal entity. They work on projects in a different legal entity.

The company must configure intercompany expenses so the tax on intercompany resource charges follows the tax rules of the loaning entity.

You need to set up sales tax for general ledger parameters.

How should you complete the configuration? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

The controller at a company has multiple employees who enter standard General ledger journals. The controller wants to review these journal entries before they are posted. Currently, journals entries are posted without review.

You need to configure Dynamics 365 Finance to help set up a system led review process to meet the controller's needs.

Which functionality should you configure?

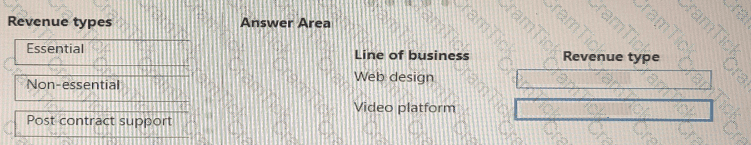

You need to configure revenue recognition to meet the requirements.

Which configuration should you use? To answer, drag the appropriate configurations to the correct requirements. Each configuration may be used once, more than not at all. You may need to drag the split bar between panes or scroll to view content

NOTE: Each correct selection is worth one point

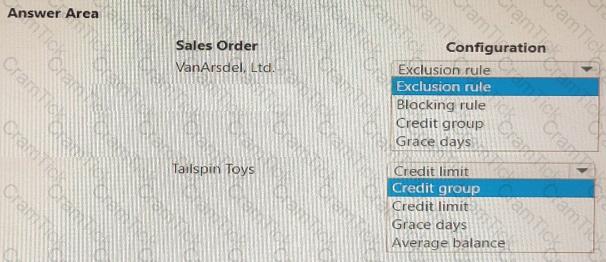

You need to identify why the sales orders where sent to customers.

Which configuration allowed the sales orders to be sent? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct select is worth one point.

You need to address the posting of sales orders to a closed period.

What should you do?

You need to configure recognition.

Which revenue type is associated with the line of business? To answer, drag the appropriate revenue types to the correct lines of business. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to identify the posting issue with sales order 1234.

What should you do?

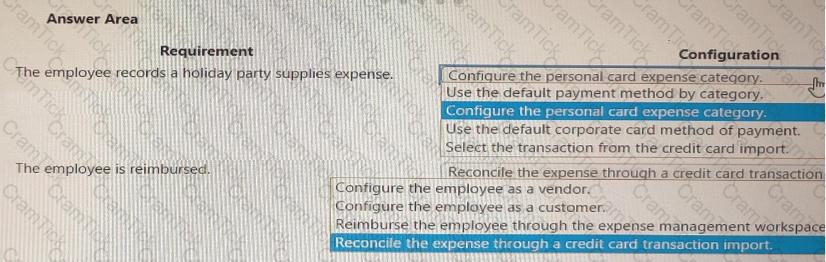

You need to configure the expense module for reimbursement.

How should you configure the expense module? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to address the employees issue regarding expense report policy violations.

Which parameter should you use?

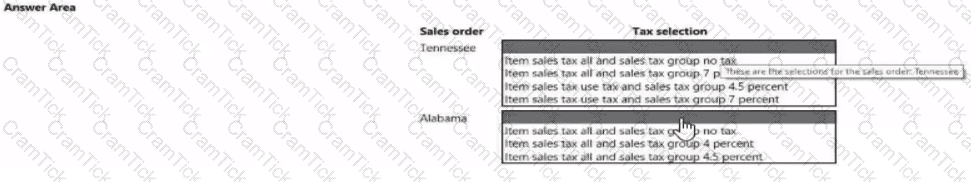

You need to validate the sales tax postings for Tennessee and Alabama.

Which tax selections meet the requirement? To answer. select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

You need in BUI that captured employee mobile receipts automatic ally match the transactions to resolve the User1 issue.

Which feature should you enable?

You need to configure the system to meet the fiscal year requirements. What should you do?

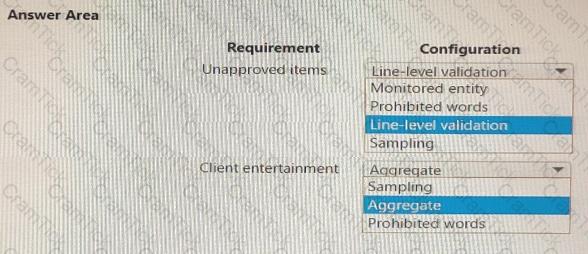

You need to prevent prohibited expenses from posting.

Which configurations should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

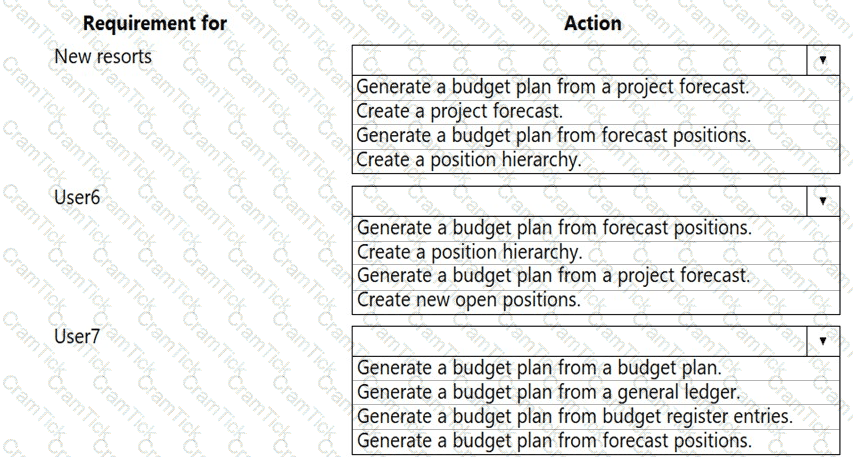

You need to configure the system to meet the budget preparation requirements.

What should you do? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You work for a company that receives invoices in foreign currencies.

You need to configure the currency exchange rate providers and exchange rate types.

What should you do?

A company has implemented Dynamics 365 Finance.

The company pays taxes quarterly to the states of Florida, Nebraska, and Washington. These states have been set up as tax authorities within Dynamics 365 Finance.

You need to configure the system to remit tax payments.

What should you do?

You are implementing Dynamics 365 Finance.

Sales tax payable must be posted to the same collection of accounts across all legal entities. You need to configure the sales tax. What should you use?

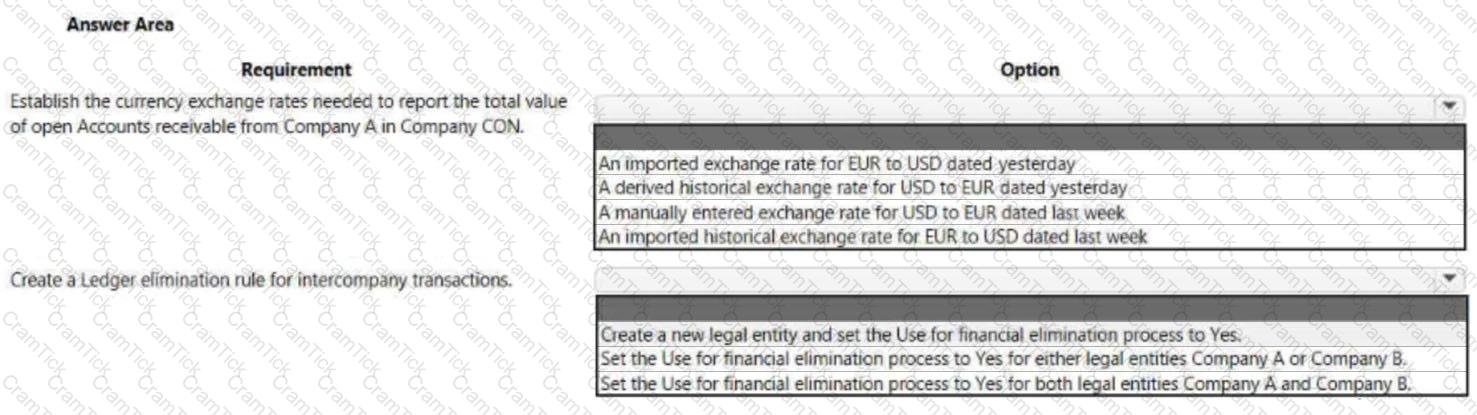

A company is implementing Dynamics 365 Finance.

The company must be able to record sales orders in the following currencies: USD. EUR, and GBP.

Company A uses USD as the accounting and reporting currency

Company B uses GBP as the accounting and reporting currency.

Each company is consolidated into Company CON that uses EUR as the accounting and reporting currency.

Assets and liabilities are revalued at the current exchange rate.

You need to configure the system to meet the requirement.

Which option should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

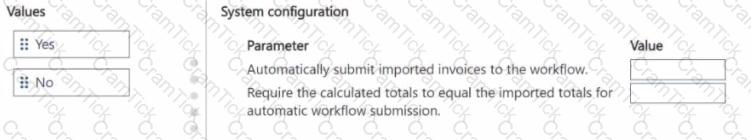

You need to resolve the accounts payable manager issue and resolve the user acceptance testing bug reported by the accounts payable clerk.

How should you configure the system? To answer, move the appropriate Value to the correct Parameter. You may use each Value once, more than once, or not at all. You may need to move the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

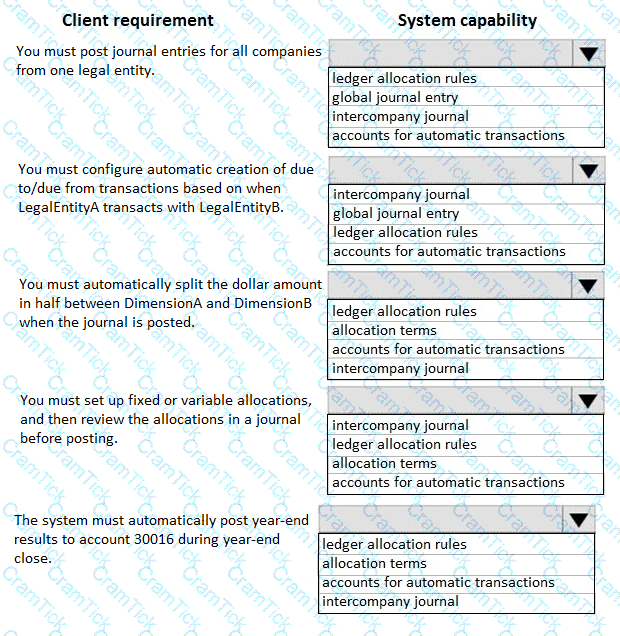

You are implementing a Dynamics 365 for Finance and Operations General ledger module for a client that has multiple legal entities.

The client has the following requirements:

• Post journal entries for all companies from one legal entity.

• Configure automatic creation of due to/due from transactions based on when LegalEntityA transacts with LegalEntityB.

• Automatically split the dollar amount in half between DimensionA and DimensionB when the journal is posted.

• Set up fixed or variable allocations, and then review the allocations in a journal before posting,

• Automatically post year-end results to account 30016 during year-end close.

You need to configure the system.

Which system capability should you configure? To answer, select the appropriate configuration in the answer area.

You are the accounts receivable manager of an organization. The organization recently sold machinery to a customer. You need to registers transaction for the sale of the machinery by using a free text invoice for fixed assets. Which transaction type should you use?

You need to determine the cause of the issue that User1 reports.

What are two possible causes for the issue? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

You need to set up financial reports to meet management requirements. What should you do? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

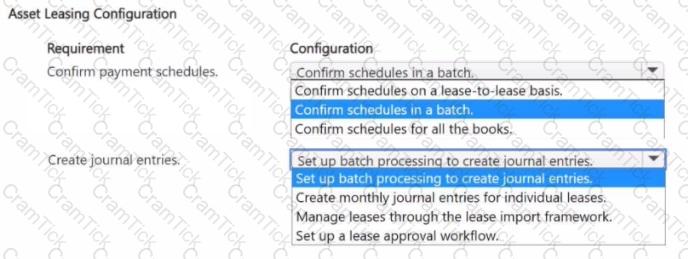

You need to resolve the issue related to monthly lease expenses.

How should you configure asset leasing? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to enforce financial budgets for management and resolve User As issue. What should you do?

You need to select the functionality to meet the requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to determine the root cause for User1’s issue.

Which configuration options should you check? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to identify the root cause for the error that User5 is experiencing.

What should you check?

You need to configure Accounts Receivable to take pre-orders.

Which feature should you use?

You need to recommend a solution to prevent User3's issue from recurring.

What should you recommend?

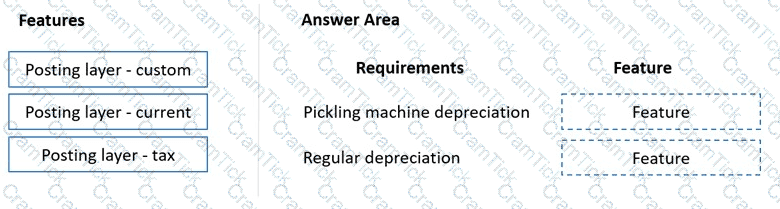

You need to configure system functionality for pickle type reporting.

What should you use?

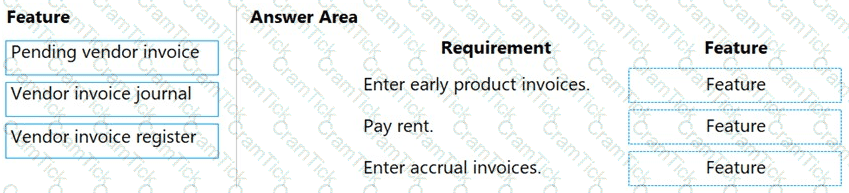

You need to configure the system to meet invoicing requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

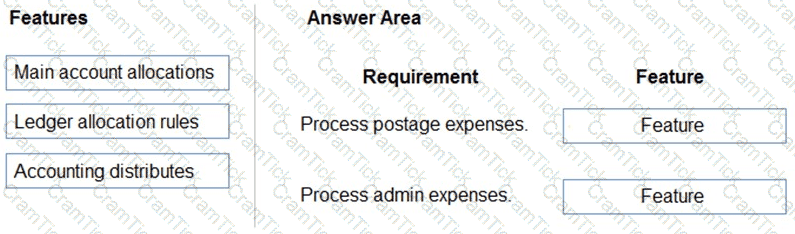

You need to process expense allocations.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or net at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to configure expense management tor Humongous Insurance and its subsidiary. Which options should you use? To answer select the appropriate options in me answer area

NOTE: Each correct selection is worth one point.

You need to ensure accounting entries are transferred from subledgers to general ledgers.

How should you configure the batch transfer rule? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to configure the posting groups for Humongous insurance s subsidiary. Which ledger posting group field should you use?

You need to configure the cash flow management reports.

How should you configure cash flow management? To answer, select the appropriate options m the answer area.

NOTE: Each correct selection is worth one point.

Financials Functional Consultant Associate | MB-310 Exam Topics | MB-310 Questions answers | MB-310 Test Prep | Microsoft Dynamics 365 Finance Exam Questions PDF | MB-310 Online Exam | MB-310 Practice Test | MB-310 PDF | MB-310 Test Questions | MB-310 Study Material | MB-310 Exam Preparation | MB-310 Valid Dumps | MB-310 Real Questions | Financials Functional Consultant Associate MB-310 Exam Questions