U+ Bank follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card, Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

A telecommunications company is promoting IPhone upgrades with unlimited data plans. The marketing team notices that a customer explicitly stated in a recent survey that they are not interested in iPhone products. The company wants to apply appropriate engagement policy conditions to respect customer preferences.

Which engagement policy condition type should you use to prevent iPhone offers for customers who express disinterest?

As a decisioning architect, you advise the board on the business issues for which they must use the Next-Best-Action strategy. Which three business issues do you recommend? (Choose Three)

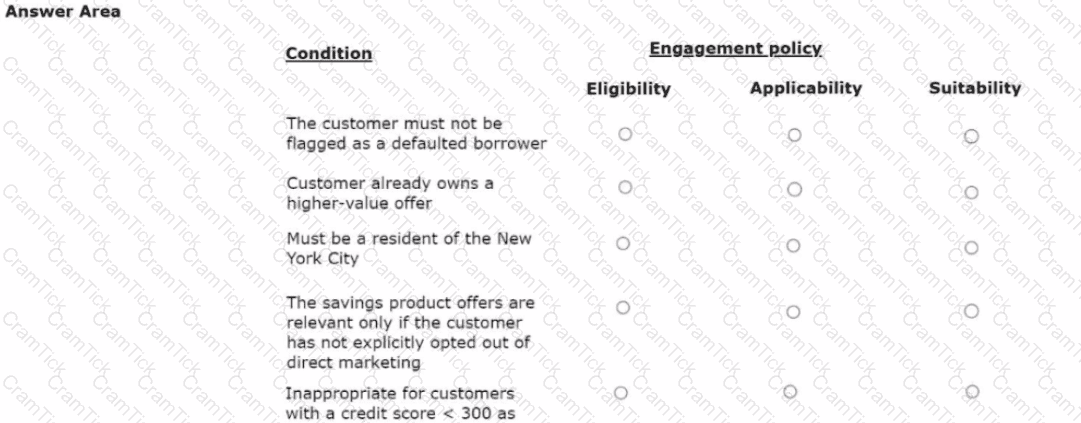

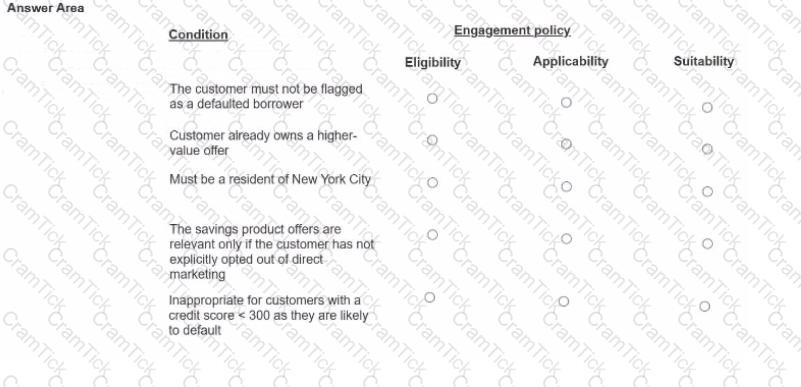

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal. The bank added engagement policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

MyCo, a telecom company, wants to start promoting data plan offers through SMS to qualified customers. The marketing team needs to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

U+ Bank implemented multiple customer journeys for Its customers. The goal of the bank Is to present the most relevant action for the customer to increase the chance of a positive outcome. U+ Bank is sure that customers see the next best action, regardless of the current journey that they are in.

Which statement is true about customer journeys in Pega Customer Decision Hub?

A mortgage company defines a new suppression policy to limit promotional emails for home loan offers. The policy is complete, but it must be applied to all to home loan actions. The implementation team must associate this policy with the appropriate business structure.

Where should the team associate the contact policy to apply it to home loan promotions?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

1yCo, a telecom company, wants to start promoting data plan offers through SMS to qualified customers. The marketing team needs to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

A financial services company has implemented always-on outbound campaigns for three credit card offers: Standard card. Rewards card, and Rewards Plus card. The marketing team observes that customers who are qualified for multiple actions receive different numbers of offers, depending on the configuration of the volume constraint mode. To optimize customer engagement, the system administrator must choose between constraint modes.

Which volume constraint mode ensures that customers receive all actions for which they qualify, provided the actions do not reach volume limits?

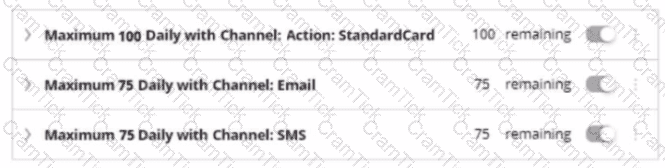

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel. If the following volume constraint is applied, how many actions are delivered by the outbound run?

MyCo, a telecom company, wants to use Pega Customer Decision Hub™ to send the MyFone Pro offer through email to qualified customers. In preparation, the marketing team created an action, a treatment, and an action flow. As a decisioning architect, you verify the settings in the Channel tab of Next-Best-Action Designer to enable email communication.

To implement this requirement, the completion of which two tasks do you verify in the Channel tab of Next-Best-Action Designer? (Choose Two)

U+ Bank decides to introduce a credit cards group by leveraging the Next-Best-Action capability of Pega Customer Decision Hub™. The bank wants to present the credit card offers through inbound and outbound channels based on the following criteria:

1. Customers must be above the age of 18 to qualify for credit card offers.

2. The site offers credit cards only if customers do not explicitly opt-out of any direct marketing for credit cards.

3. The Platinum Card, one of the credit card offers, is suitable for customers with debt-to-income ratio < 45.

As a decisioning architect, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

Myco Bank, a retail bank, uses the Customer Engagement Blueprint to design personalized customer journeys. The bank wants to better understand its diverse customer base to create more targeted engagement strategies.

What key achievement does the Personas stage provide for Myco Bank when implementing with Customer Engagement Blueprint?

U+ Bank implemented a customer journey for its customers. The journey consists of three stages. The first stage raises awareness about available products, the second stage presents available offers, and in the last stage, customers can talk to an advisor to get a personalized quote. The bank wants to actively increase offers promotion over time.

What action does the bank need to take to achieve this business requirement?

U+ Bank, a retail bank, introduced a new mortgage refinance offer in the eastern region of the country. They want to advertise this offer on their website by using a banner, targeting the customers who live in that area.

What do you configure in Next-Best-Action Designer to implement this requirement?

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal The Dank added engagement policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

What does a dotted line from a "Group By" component to a "Filter" component mean?

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning architect, what must you do to present offers from the two groups?

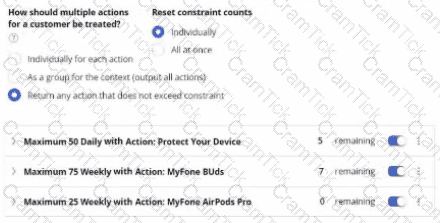

In the following figure, a volume constraint uses the Return any action that does not exceed constraint mode with the three following action type constraints that have remaining limits:

1.Maximum 50 Daily with Action: Protect Your Device, 5 remaining

2.Maximum 75 Daily with Action: MyFone Buds, 7 remaining

3.Maximum 25 Daily with Action: MyFone AirPods Pro, 0 remaining

A customer, CUST-01, qualifies for all the three actions. Given this scenario, how many actions does the system select for CUST-01 in the outbound run?

MyCo, a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its premium customers. As the bank has financial targets to meet, the business decides to boost the MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFone 14 Pro offer is prioritized over other offers?

MyCo, a telecom company, notices that when customers call to check on bill status, 80% of the time, they received the wrong offer promotion, leading to customer dissatisfaction. The company decides to boost customers' needs in the prioritization formula, to Improve sales in the current quarter.

Which arbitration factor do you configure to implement the requirement?

U+ Bank wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

U+ Bank is promoting a new premium credit card with an 18% APR to its existing customers. To protect customer value, the bank wants to avoid offering this card to customers who already hold a credit card with a lower Interest rate (12% APR or below).

Which engagement policy condition type should you use to exclude customers with lower-interest cards from receiving the premium offer?

A customer qualifies for Standard card (priority 60), Rewards card {priority 40), and Premium card {priority 30). Standard card volume is exhausted. Rewards card has remaining volume, and Premium card has remaining volume. The system uses "Return any action that does not exceed constraint" mode.

Which actions does the customer receive in this scenario?

Regional Bank experiences an unexpected system outage affecting online banking services across multiple locations. The bank needs to immediately inform all customers about the temporary service disruption and provide alternative banking options. The communication must reach every customer simultaneously and should not be repeated.

Which communication approach should the bank use to address this urgent customer notification requirement?

U+ Bank wants to offer a Gold credit card to customers who have an annual income of more than USD150000. What do you configure in the Next-Best-Action Designer to achieve this outcome7

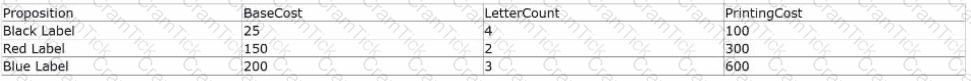

As a decisioning architect, you have built a decision strategy that selects actions that are below the average printing cost. The decision strategy contains 'Black Label', 'Red Label,' and 'Blue Label" Proposition components. The printing cost of the Proposition components are calculated based on the 'BaseCost' and 'LetterCount*.

The details of the proposition components are provided in the following table:

Which propositions does the strategy output?