Which one of the following four factors typically drives the pricing of wholesale products?

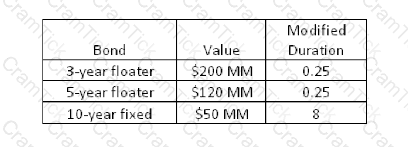

A bank owns a portfolio of bonds whose composition is shown below.

What is the modified duration of the portfolio?

Which one of the following four exercise features is typical for the most exchange-traded equity options?

Which one of the four following statements about a minimal loss threshold in operational loss data collection is incorrect?

Bank Sigma has an opportunity to do a securitization deal for a credit card company, but has to retain a portion of the residual risk of the deal with an estimated VaR of $8 MM. Its fees for the deal are $2 MM, and the short-term financing costs are $600,000. What would be the RAROC for this transaction?

Unico Delta stock is trading at $20 per share, its annualized dividend yield is 5% and the 12-month LIBOR is 3%. Given these statistics, the 12-month futures contact will trade at:

Which one of the four following statements about technology systems for managing operational risk event data is incorrect?

A trader inadvertently booked a trade with incorrect information. A subsequent market move resulted in a gain to the bank. Should the bank include this amount of gain into its operational loss event data program?

I. The bank should include this gain in its operational loss event data program as a gain realized due to operational risk events.

II. The bank should include this gain in its operational loss event data program as it indicates that a control failed or a process is flawed.

III. The bank should include this event in its operational loss event data program and record the gain as a loss resulting from operational risk.The bank should not include this event in its operational loss event data program as it is not a loss event, but a market risk event.

Which one of the four following activities is NOT a component of the daily VaR computing process?

In its VaR calculations, JPMorgan Chase uses an expected tail-loss methodology which approximates losses at the 99% confidence level. This methodology consists of two subsequent steps to estimate the VaR. Which of the following explains this two-step methodology?

For what reason does risk appetite usually mature as the operational risk program develops?

A key function of treasuries in commercial/retail banks is:

I. To manage the interest margin of the banks.

II. To focus on underwriting risk.

III. To ensure strong earnings.

IV. To increase profit margins.

Present value of a basis point (PVBP) is one of the ways to quantify the risk of a bond, and it measures:

Gamma Bank is operating in a highly volatile interest rate environment and wants to stabilize its net income by shifting the sources of its earnings from interest rate sensitive sources to less interest rate sensitive sources. All of the following strategies can help achieve this objective EXCEPT:

In hedging transactions, derivatives typically have the following advantages over cash instruments:

I. Lower credit risk

II. Lower funding requirements

III. Lower dealing costs

IV. Lower capital charges

An organization's enterprise risk management framework defines its risk profile and typically reflects the organization's

I. Market and credit risks

II. Operational and liquidity risks

III. Strategic and geopolitical risks

IV. Structural developments and industry position

What are some of the drawbacks of correlation estimates? Which of the following statements identifies major problems with correlation calculations?

I. Correlation estimates are not able to capture increases in factor co-movements in extreme market scenarios.

II. Correlation estimates tend to be unstable.

III. Historical correlations may not forecast future correlations correctly.

IV. Correlation estimates assume normally distributed returns.

Which one of the following statements is an advantage of using implied volatility as an input when calculating VaR?

The technique of using interest rate swap positions to reduce the effect of the variability of interest rates on net interest income is known as:

Which of the following statements regarding CDO-squared is correct?

I. CDO-squared use other CDOs and CMOs as collateral.

II. Risk assessment of CDO-squared is almost impossible due to their complexity.

III. CDO-squared have lower credit risk than CMOs but higher than CDOs.

Returns on two assets show very strong positive linear relationship. Their correlation should be closest to which of the following choices?

A risk analyst is considering how to reduce the bank's exposure to rising interest rates. Which of the following strategies will help her achieve this objective?

I. Reducing the average repricing time of its loans

II. Increasing the average repricing time of its deposits

III. Entering into interest rate swaps

IV. Improving earnings capacity and increasing intermediated funds

Which one of the following is a reason for a bank to keep a commercial loan in its portfolio until maturity?

I. Commercial loans usually have attractive risk-return profile.

II. Commercial loans are difficult to sell due to non standard features.

III. Commercial loans could be used to maintain good relations with important customers.

IV. The credit risk in commercial loans is low.

Mega Bank has $100 million in deposits on which it pays 3% interest, and $20 million in equity on which it pays no interest. The loan portfolio of $120 million earns an average rate of 10%. If the rates remain the same, what is the net interest income of Mega Bank?

All of the following factors generally explain the equity bid-offer spread in a market EXCEPT:

James Johnson bought a 3-year plain vanilla bond that has yield of 4.7% and 4% coupon paid annually, for $87,139. Macauley's duration of the bond is 2.94 years. Rate volatility is 20% of the yield. The bond's annualized volatility is therefore:

Unico Bank, concerned with managing the risk of its trading strategies, wants to implement the trading strategy that exposes the bank to the lowest market risk. Which one of the following four strategies should Unico take to limit its risk exposure?

Arnold Wu owns a floating rate bond. He is concerned that the rates may fall in the future decreasing his payment amount. Which of the following instruments should he buy to hedge against the fall in interest rates?

The skewness of ABC company's stock returns equal -1.5. What is the correct interpretation of this?

In order to comply with key risk indicator (KRI) standards, a data analyst will set the following criteria for each indicator except:

Rising TED spread is typically a sign of increase in what type of risk among large banks?

I. Credit risk

II. Market risk

III. Liquidity risk

IV. Operational risk

The risk management department of VegaBank wants to set guidelines on commodity carry trades. Which of the following strategies should she pursue to achieve a profitable commodity carry?

I. Buy short-term commodity futures and sell longer-dated position when the curve is in contango.

II. Buy short-term commodity futures and sell longer-dated position when the curve is in backwardation.

III. Buy long-term commodity futures and sell shorter-dated positions when the curve is in contango.

IV. Buy long-term commodity futures and sell shorter-dated positions when the curve is in backwardation.

An asset and liability manager for a large financial institution has to recognize that retail products ___ include embedded options, which are often not rationally exercised, while wholesale products ___ carry penalties for repayment or include rights to terminate wholesale contracts on very different terms than are common in retail products.

Sam has hedged a portfolio of bonds against a small parallel shift in the yield curve using the duration measure. What should Sam do to ensure that the portfolio is hedged against larger parallel shifts in the yield curve?

A large multinational bank is concerned that their duration measures may not be accurate since the yield curve shifts are not parallel. Which of the following statements would be typically observed regarding variability of interest rates?

A governance, risk, and compliance strategy can help a bank to avoid:

I. Incomplete analysis of risks

II. Misperception of risk exposures

III. Duplication of effort

IV. Contradictory reporting

Which one of the following is the underlying contract for an Asian commodity option?

Which one of the following four statements about regulatory capital for a bank is accurate?

Of all the risk factors in loan pricing, which one of the following four choices is likely to be the least significant?

Which of the following attributes are typical for early models of statistical credit analysis?

Which one of the following four models is typically used to grade the obligations of small- and medium-size enterprises?

Which one of the following four model types would assign an obligor to an obligor class based on the risk characteristics of the borrower at the time the loan was originated and estimate the default probability based on the past default rate of the members of that particular class?

A risk manager is considering how to best quantify option price dynamics using mathematical option pricing models. Which of the following variables would most likely serve as an input in these models?

I. Implicit parameter estimate based on observed market prices

II. Estimates of sensitivity of option prices to parameter changes

III. Theoretical option determination based on assumptions

Foreign exchange rates are determined by various factors. Considering the drivers of exchange rates, which one of the following changes would most likely strengthen the value of the USD against other foreign currencies?

A hedge fund trader buys options to establish an exposure in the currency market, thereby effectively removing the risk of being able to participate in a gapping market. In this case the options premium represents the price paid for eliminating the execution risk of

What is the explanation offered by the liquidity preference theory for the upward sloping yield curve shape?

Which one of the following four statements about the relationship between exchange rates and option values is correct?

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan is collateralized with $55,000. The loan also has an annual expected default rate of 2%, and loss given default at 50%. In this case, what will the bank's expected loss be?

A risk manager has a long forward position of USD 1 million but the option portfolio decreases JPY 0.50 for every JPY 1 increase in his forward position. At first approximation, what is the overall result of the options positions?

Counterparty credit risk assessment differs from traditional credit risk assessment in all of the following features EXCEPT:

Which one of the following four variables of the Black-Scholes model is typically NOT known at a point in time?

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan also has an annual expected default rate of 2%, and loss given default at 50%. In this case, what will the bank's expected loss be? What is the expected loss of this loan?

A credit analyst wants to determine a good pricing strategy to compensate for credit decisions that might have been made incorrectly. When analyzing her credit portfolio, the analyst focuses on the spreads in each loan to determine if they are sufficient to compensate the bank for all of the following costs and risks EXCEPT.

Which one of the following four features is NOT a typical characteristic of futures contracts?

Typically, which one of the following four option risk measures will be used to determine the number of options to use to hedge the underlying position?

Which of the following risk types are historically associated with credit derivatives?

I. Documentation risk

II. Definition of credit events

III. Occurrence of credit events

IV. Enterprise risk

Which one of the following four parameters is NOT a required input in the Black-Scholes model to price a foreign exchange option?

A credit risk analyst is evaluating factors that quantify credit risk exposures. The risk that the borrower would fail to make full and timely repayments of its financial obligations over a given time horizon typically refers to:

ThetaBank has extended substantial financing to two mortgage companies, which these mortgage lenders use to finance their own lending. Individually, each of the mortgage companies has an exposure at default (EAD) of $20 million, with a loss given default (LGD) of 100%, and a probability of default of 10%. ThetaBank's risk department predicts the joint probability of default at 5%. If the default risk of these mortgage companies were modeled as independent risks, what would be the probability of a cumulative $40 million loss from these two mortgage borrowers?

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment.

What may happen to the Delta's initial credit parameter and the value of its loan if the machinery industry experiences adverse structural changes?

Which one of the four following statements regarding foreign exchange (FX) swap transactions is INCORRECT?

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment. Hence, the loss rate in this case will be

ThetaBank has extended substantial financing to two mortgage companies, which these mortgage lenders use to finance their own lending. Individually, each of the mortgage companies have an exposure at default (EAD) of $20 million, with a loss given default (LGD) of 100%, and a probability of default of 10%. ThetaBank's risk department predicts the joint probability of default at 5%. If the default risk of these mortgage companies were modeled as independent risks, the actual probability would be underestimated by:

Which one of the following four statements does identify correctly the relationship between the value of an option and perceived exchange rate volatility?

Which one of the following four alternatives lists the three most widely traded currencies on the global foreign exchange market, as of April 2007, in the decreasing order of market share? EUR is the abbreviation of the European euro, JPY is for the Japanese yen, and USD is for the United States dollar, respectively.

According to a Moody's study, the most important drivers of the loss given default historically have been all of the following EXCEPT:

I. Debt type and seniority

II. Macroeconomic environment

III. Obligor asset type

IV. Recourse

When looking at the distribution of portfolio credit losses, the shape of the loss distribution is ___ , as the likelihood of total losses, the sum of expected and unexpected credit losses, is ___ than the likelihood of no credit losses.

Which one of the following four statements regarding bank's exposure to credit and default risk is INCORRECT?

A credit portfolio manager analyzes a large retail credit portfolio. Which of the following factors will represent typical disadvantages of market-linked credit risk drivers?

I. Need to supply a large number of input parameters to the model

II. Slow computation speed due to higher simulation complexity

III. Non-linear nature of the model applicable to a specific type of credit portfolios

IV. Need to estimate a large number of unknown variable and use approximations

A risk manager is analyzing a call option on the GBP with a vega of 0.02. When the perceived future volatility increases by 1%, the call option

For which one of the following four reasons do corporate customers use foreign exchange derivatives?

I. To lock in the current value of foreign-denominated receivables

II. To lock in the current value of foreign-denominated payables

III. To lock in the value of expected future foreign-denominated receivables

IV. To lock in the value of expected future foreign-denominated payables

The value of which one of the following four option types is typically dependent on both the final price of its underlying asset and its own price history?

Which one of the following four metrics represents the difference between the expected loss and unexpected loss on a credit portfolio?

A bank customer chooses a mortgage with low initial payments and payments that increase over time because the customer knows that she will have trouble making payments in the early years of the loan. The bank makes this type of mortgage with the same default assumptions uses for ordinary mortgages, thus underestimating the risk of default and becoming exposed to:

In the United States, Which one of the following four options represents the largest component of securitized debt?

To estimate a partial change in option price, a risk manager will use the following formula:

The pricing of credit default swaps is a function of all of the following EXCEPT:

The potential failure of a manufacturer to honor a warranty might be called ____, whereas the potential failure of a borrower to fulfill its payment requirements, which include both the repayment of the amount borrowed, the principal and the contractual interest payments, would be called ___.

Which one of the following four exotic option types has another option as its underlying asset, and as a result of its construction is generally believed to be very difficult to model?

What is generally true of the relationship between a bond's yield and it's time to maturity when the yield curve is upward sloping?

According to the largest global poll of foreign exchange market participants, which one of the following four global financial institutions was the most active participant in the global foreign exchange market?

A credit rating analyst wants to determine the expected duration of the default time for a new three-year loan, which has a 2% likelihood of defaulting in the first year, a 3% likelihood of defaulting in the second year, and a 5% likelihood of defaulting the third year. What is the expected duration for this three-year loan?

Which one of the following four statements correctly defines a non-exotic call option?

Which one of the following four formulas correctly identifies the expected loss for all credit instruments?

In the United States, foreign exchange derivative transactions typically occur between

Which one of the following four statements correctly describes an American call option?

Beta Insurance Company is only allowed to invest in investment grade bonds. To maximize the interest income, Beta Insurance Company should invest in bonds with which of the following ratings?

To estimate the interest charges on the loan, an analyst should use one of the following four formulas:

Which one of the following changes would typically increase the price of a fixed income instrument, such as a bond?

Which of the following statements about the interest rates and option prices is correct?

Except for the credit quality of the Credit Default Swap protection seller, the following relationship correctly approximates the yield on a risk-free instrument:

By lowering the spread on lower credit quality borrowers, the bank will typically achieve all of the following outcomes EXCEPT:

After entering the securitization business, Delta Bank increases its cash efficiency by selling off the lower risk portions of the portfolio credit risk. This process ___ risk on the residual pieces of the credit portfolio, and as a result it ___ return on equity for the bank.

Oliver McCarthy owns a portfolio of bonds. Which of the following choices equals the modified duration of Oliver's portfolio?

A corporate bond was trading with 2%probability of default and 60% loss given default. Due to the credit crisis the probability of default increased to 10% and the loss given default increased to 100%. Assuming that the risk premium remained the same how did the credit spread change?

After one year and spending USD 1.0 million, a bank finally succeeds in recovering USD 10 million on an exposure that, at the time of its default, was valued at USD 20 million. If the recovery discount rate is 10%, what is the estimate of the recovery rate?

Which one of the following is an advantage of using a daily decay factor when forecasting tomorrow’s P&L?

US-based BetaBank have accumulated Japanese yen, Japanese government bonds, options on Japanese yen, and positions in commodities that have a positive correlation with yen. Which one of the four following non-statistical risk measures could be used to evaluate the BetaBank's exposure to the Japanese economy?

James manages a loans portfolio. He has to evaluate a large number of loans to choose which of them he will keep in the bank's books. Which one of the following four loans would he be most likely to sell to another bank?

Over a long period of time DeltaBank has amassed a large equity option position. Which of the following risks should be considered in this transaction?

I. Counterparty risk on long OTC option positions

II. Counterparty risk on short OTC option positions

III. Counterparty risk on long exchange-traded option positions

IV. Counterparty risk on short exchange-traded option positions

A bank customer expecting to pay its Brazilian supplier BRL 100 million asks Alpha Bank to buy Australian dollars and sell Brazilian reals. Alpha bank does not hold reals so it asks for a quote to buy Brazilian reals in the market. The market rate is 100. The bank quotes a selling rate of 101 to its customer and sells the real at this quoted price. Then the bank immediately buys the real at the market rate and completes foreign exchange matched transaction. What is the impact of this transaction on the bank's risk profile?

Which of the following are typical properties of a statistical distribution of potential losses that a bank might sustain over a period of time?

I. The range of possible losses above the average loss is much greater than those below the average loss.

II. The loss that is most likely to occur is below the average loss.

III. The loss that is most likely to occur is above the average loss.

Which of the following statements presents an advantage of using risk and control self-assessments (RCSA) in the operational risk framework?

I. RCSA provides very accurate scoring of risks and controls due to its subjective nature.

II. RCSA program provides insight into risks that exist in a firm, but that may or may not have occurred before.

III. RCSA program can produce biased but transparent operational risk reporting.

IV. RCSA program allows each department to take ownership of its own risks and controls.

Bank Milo has $4 million in cash and $5 million in loans coming due tomorrow with an expected default rate of 1%. The proceeds will be deposited overnight. The bank owes $ 9 million on a securities purchase that settles in two days and pays off $8 million in commercial paper in three days that is not expected to renew. On what days does the bank face negative cumulative liquidity?

Financial Risk and Regulation | 2016-FRR Questions Answers | 2016-FRR Test Prep | Financial Risk and Regulation (FRR) Series Questions PDF | 2016-FRR Online Exam | 2016-FRR Practice Test | 2016-FRR PDF | 2016-FRR Test Questions | 2016-FRR Study Material | 2016-FRR Exam Preparation | 2016-FRR Valid Dumps | 2016-FRR Real Questions | Financial Risk and Regulation 2016-FRR Exam Questions