You quote a customer spot AUD/USD at 1.0350-55. The T/N swap is quoted to you at 3/2. The customer asks to buy USD for value tomorrow. What rate should you quote him to break-even against the other rates?

You have quoted your customer the following eurodollar deposit rates:

1M 5.375-25%

2M 5.4375-3125%

3M 5.5-375%

The customer says, “I give you USD 20 million in the two’s”.

What have you done?

From the following GBP deposit rates:

1M (30-day) GBP deposits 0.45%

2M (60-day) GBP deposits 0.50%

3M (91-day) GBP deposits 0.55%

4M (123-day) GBP deposits 0.65%

5M (153-day) GBP deposits 0.70%

6M (184-day) GBP deposits 0.75%

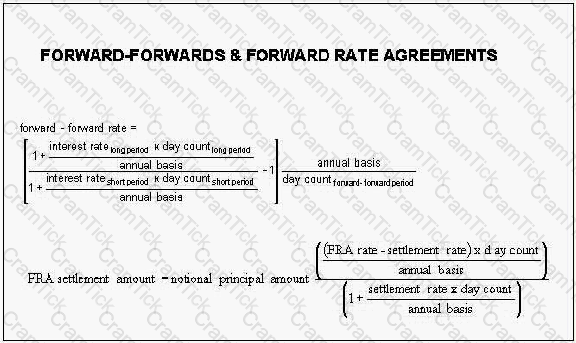

Calculate the 3x4 forward-forward rate.

The Committee for Professionalism strongly recommends intra-day oral deal checks to help reduce the number and size of differences, particularly when dealing through voice-brokers, for deals involving foreign counterparties, in faster moving markets such as FX and when dealing in other instruments which have very short settlement periods.

This checking should:

The use of standard settlement instructions (SSI’s) is strongly encouraged because:

Clients of a voice-broker quote EUR/USD at 1.3556-61, 1.3559-62, 1.3557-63 and 1.3555-59.

What will be the broker’s price?

One or your brokers asks you to buy and sell EUP/USD at the same price net of brokerage in order to allow him to clear a transaction.

The tom/next GC repo rate for German government bonds is quoted to you at 1.75-80%. As collateral, you sell EUR 10,000,000.00 nominal of the 5.25% Bund July 2012, which is worth EUR 11,260,000.00, with no initial margin. The Repurchase Price is:

What do you call a combination of a long (short) call option and short (long) put option with same face value, same expiration date, same style, where the strike price is equal to the forward price?

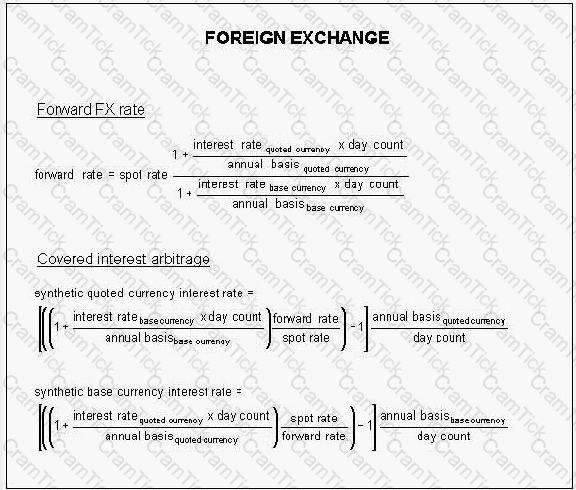

You are quoted the following market rates:

spot EUR/USD. 1.2250

3M (91-day) EUR 2.55%

3M (91-day) USD. 2.00%

What is 3-month EUR/USD?

When constructing a gap report, how would a EUR 25,000,000.00 long position in 6x12 FRA be categorized?

If the value of the collateral in a repo has fallen during the term of the transaction, who suffers the loss?

With regard to operational risk awareness, which of the following best practices is incorrect?

Between which departments are clear and structured escalation procedures required for the management of incorrect funding balances?

The one-month (31-day) GC repo rate for French government bonds is quoted to you at 3.75- 80%. As collateral, you are offered EUR 25,000,000.00 nominal of the 5.5% OAT April 2015, which is worth EUR 28,137,500.00. If you impose an initial margin of 1%, the Repurchase Price is:

If a broker refers to “the payer of 5-year euro at 4.12”, what is this party doing?

Which of the following statements is an incorrect statement in respect of Model Code recommendations concerning electronic trading?

Four banks provide you with quotes in CHF/SEK. Which is the best price for you to buy SEK?

What rate should be used if the settlement date in a foreign exchange transaction is no longer a “good” date?

Where internet trading facilities are established by a bank for a client, the conditions and controls should be stated in a rulebook produced by:

You have a USD loan that is priced at 3-month LIBOR+50. LIBOR for the loan will be re-fixed in exactly one month. The market is quoting:

1x3 USD FRA. 1.95-98%

1x4 USD FRA. 2.07-10%

1x6 USD FRA 2.25-28%

To hedge the next LIBOR fixing, you should:

A sold JUN 3-month STIR-future should be reported in the gap report as of 22 May:

3-month USD/CHF is quoted at 112/110. Interest rates in Switzerland are reduced but USD rates (which are higher) are unchanged. What would you expect the 3-month forward USD/CHF rate to be?

If you buy GBP 2,000,000 against USD at 1.6020; GSP 1,000,000 at 1.6035 and GBP 3,000,000 at 1.6028, what is the average rate of your position?

A 3-month (90-day) USD deposit is 5.5625% and 6-month (180-day) USD deposit is 5.75%. What is the 3x6 USD deposit rate?

What is the documentation in which the parties agree to the terms that will govern future transactions?

If making a claim in respect of “use of funds”, payments should be settled within how many days?

A customer sells a 3-month Euro Swiss Franc (EUROSWISS) futures contract. Which of the following risks could he be trying to hedge?

A dealer has indicated his intention of assigning an interest rate swap to a third party soon after transacting that swap. When about to execute an assignment

A 3-month (91-day) UK Treasury bill with a face value of GBP 50,000,000.00 is quoted at a yield of 4.25%. How much is the bill worth?

If there is a need for assistance to help resolve a dispute over differences between a broker and a bank, the Model Code suggests turning to:

You quote a price to a broker on EUR 100 million. Your price is hit for EUR 50 million. What does the Model Code say about this situation?

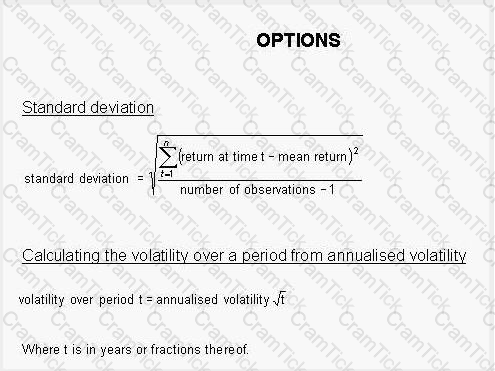

If the daily 90% confidence level VaR of a portfolio is correctly estimated to be USD 5,000.00, one would expect that:

An option granted by the seller that gives the buyer the right to enter into an underlying interest rate swap transaction is ca lied:

What does the Model Code recommend regarding the practice of “name switching/substitution”?

How much is a big figure worth per million of base currency it EUR/GBP is 0.6990?

How many USD would you have to invest at 3.5% to be repaid USD125 million (principal plus interest) in 30 days?

Today is the fixing date for a 6x9 FRA that you sold at 2.55%. BBA LIBOR fixes at 2.7175%.

Which of the following is true?

What should be done if a broker fails to conclude a transaction at the quoted price and the dealer has to accept a lesser quote to neutralize his risk?

You are quoted the following rates:

Spot cable1.5340-43

0/N cable swap0.14/0.11

T/N cable swap0.16/0.13

S/N cable swap0.43/0.37

At what rate can you buy cable for value tomorrow?

A customer gives you GBP 25,000,000.00 at 0.625% same day for 7 days.

Through a broker, you place the funds with a bank for the same period at 0.6875%.

Brokerage is charged at 2 basis points per annum.

What is the net profit or loss on the deal?

Principals who enter into an interest rate swap with the intention of shortly afterwards assigning or transferring the swap to a third party:

The primary issue for insuring prudent liquidity management in accord with the guidance provided by the Basel Committee (Basel II I Basel III) is:

What is the correct interpretation of a EUR 5,000,000.00 one-week VaR figure with a 99% confidence level?

Which of the following is not the responsibility of the asset and liability committee (ALCO)?

Which one of the following statements correctly describes the increased capital ratios that will come into effect under Basel III?

If spot AUD/USD is quoted to you as 1.0420-25 and 1-month forward AUD/USD is quoted to you as 28/23, at what rate can you buy USD 1-month outright?

A bond is trading 50 basis points special for 1 week, while the 1-week GC repo rate is 3.25%. If you held GBP 10,500,000.00 of this bond, what would be the cost of borrowing against it in the repo market?

Which of the following is typical of liquid assets held by banks under prudential requirements?

Your are quoted the following rates:

Spot CHF/JPY105.12-22

3M CHF/JPY 3.5/4.5

At what rate can you buy 3-month outright JPY against CHF?

You quote a price to a broker. It is hit by another bank, but you are not informed until some time afterward that the deal has been done. Who is to blame?

Under Basel rules the risk weight for claims on unrated sovereigns and their cennl banks in the standardized approach is:

Clients of a voice-broker quote EUR/GBP at 0.8345-50, 0.8346-51, 0.8348-53 and 0.8349-53. What will be the broker’s price?

3-month EUR/USD FX swaps are quoted to you at 8/12. If the “points are in your favor”, what have you done?

What recommendation does the Model Code make to banks accepting a stop-loss order?

In the international market, a FRA in USD is usually settled with reference to:

The two-week repo rate for the 5.25% Bund 2014 is quoted to you at 3.33-38%. You agree to reverse in bonds worth EUR 266,125,000.00 with no initial margin.

You would earn repo interest of:

What is the result of combining a 1-month buy and sell FX swap with a 2-month sell and buy FX swap?

The popularity of FX-trading via Internet platforms has serious implications for the applicability of traditional rules such as “Know Your Customer”. Which of the following are correct?

You borrow GBP 2,500,000.00 at 0.625% for 165 days. How much do you repay including interest?

By what means should a financial institution preferably submit SSI changes and notifications to its clients?

A CD with a face value of USD 250,000,000.00 was issued at par with a coupon of 5% for 91 days.

You buy it in the secondary market when it has 30 days remaining to maturity and is trading at

5.25%. How much do you pay?

Under the Model Code, if a broker shouts “done” or “mine” at the very moment a dealer shouts “off”:

Using the following rates:

Spot GBP/CHF1.4235-55

Spot CHF/SEK6.8815-45

3M GBP/SEK swap 140/150

What is the price for 3-month outright GBP/SEK?

As to the Charter of ACI - The Financial Markets Association, what do members not pledge?

Which one of the following statements about mark-to-model valuation is correct?

What is the name of the reference against which most USD and JPY deposits and loans are fixed in London?

Which of the following may pay a return as a mix of income and capital/gain loss?

ACI-Financial | 3I0-012 Questions Answers | 3I0-012 Test Prep | ACI Dealing Certificate Questions PDF | 3I0-012 Online Exam | 3I0-012 Practice Test | 3I0-012 PDF | 3I0-012 Test Questions | 3I0-012 Study Material | 3I0-012 Exam Preparation | 3I0-012 Valid Dumps | 3I0-012 Real Questions | ACI-Financial 3I0-012 Exam Questions