The Atoll Health Plan must comply with a number of laws that directly affect the plan's contracts. One of these laws allows Atoll's plan members to receive medical services from certain specialists without first being referred to those specialists by a primary care provider (PCP). This law, which reduces the PCP's ability to manage utilization of these specialists, is known as _________.

The following statements are about the financial risks for health plans in Medicare and Medicaid markets. Three of these statements are true, and one statement is false. Select the answer choice containing the FALSE statement.

With regard to the financial statements prepared by health plans, it can correctly be stated that

The following statements illustrate common forms of capitation:

1. The Antler Health Plan pays the Epsilon Group, an integrated delivery system (IDS), a capitated amount to provide substantially all of the inpatient and outpatient services that Antler offers. Under this arrangement, Epsilon accepts much of the risk that utilization rates will be higher than expected. Antler retains responsibility for the plan's marketing, enrollment, premium billing, actuarial, underwriting, and member services functions.

2. The Bengal Health Plan pays an independent physician association (IPA) a capitated amount to provide both primary and specialty care to Bengal's plan members. The payments cover all physician services and associated diagnostic tests and laboratory work. The physicians in the IPA determine as a group how the individual physicians will be paid for their services.

From the following answer choices, select the response that best indicates the form of capitation used by Antler and Bengal.

Under GAAP, three approaches to expense recognition are generally allowed: associating cause and effect, systematic and rational allocation, and immediate recognition. A health plan most likely would use the approach of systematic and rational allocation in order to

The following statements are about the new methodology authorized under the Balanced Budget Act of 1997 (BBA) for payments by the Centers for Medicaid & Medicare Services (CMS) to Medicare-contracting health plans.

Select the answer choice containing the correct statement.

The following paragraph contains two pair of terms enclosed in parentheses. Determine which term in each pair correctly completes the statements. Then select the answer choice containing the two terms you have chosen.

In a typical health plan, an (actuary / underwriter) is ultimately responsible for the determination of the appropriate rate to charge for a given level of healthcare benefits and administrative services in a particular market. The (actuary / underwriter) assesses and classifies the degree of risk represented by a proposed group or individual.

The Eagle health plan wants to limit the possibility that it will be held vicariously liable for the negligent acts of providers. Dr. Michael Chan is a member of an independent practice association (IPA) that has contracted with Eagle. One step that Eagle could take in order to limit its exposure under the theory of vicarious liability is to

A health plan can use a SWOT (strengths, weaknesses, opportunities, and threats) analysis to analyze its relationships with the major providers in each market in which it conducts business.

The Coral Health Plan, a for-profit health plan, has two sources of capital:

Debt and equity. With regard to these sources of capital, it can correctly be stated that

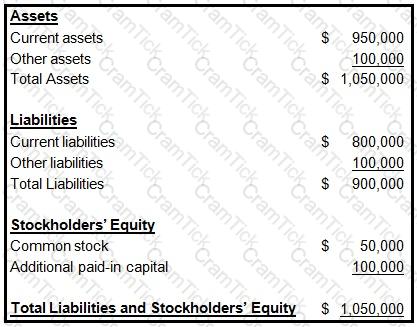

The following information was presented on one of the financial statements prepared by the Rouge health plan as of December 31, 1998:

When calculating its cash-to-claims payable ratio, Rouge would correctly divide its:

The medical loss ratio (MLR) for the Peacock health plan is 80%. Peacock's expense ratio is 16%.

Peacock's MLR and its expense ratio indicate that Peacock

The physicians who work for the Sunrise Health Plan, a staff model HMO, are paid a salary that is not augmented with another type of incentive plan. Compared to the use of a traditional reimbursement method, Sunrise's use of a salary reimbursement method is more likely to

The Challenger Group is a type of management services organization (MSO) that purchases the assets of physician practices, provides practice management and administrative support services to participating providers, and offers physicians a long-term contract and an equity position in Challenger. This information indicates that Challenger is a type of health plan

If the operational budget prepared by the Satilla health plan is typical of most operational budgets, then

In order to determine a health plan's quick liquidity ratio, a financial analyst would divide the health plan's

The Caribou health plan is a for-profit organization. The financial statements that Caribou prepares include balance sheets, income statements, and cash flow statements. To prepare its cash flow statement, Caribou begins with the net income figure as reported on its income statement and then reconciles this amount to operating cash flows through a series of adjustments. Changes in Caribou's cash flow occur as a result of the health plan's operating activities, investing activities, and financing activities.

The main purpose of Caribou's balance sheet is to

An actuary for the Noble Health Plan observed that the plan's actual morbidity was lower than its assumed morbidity and that the plan's actual administrative expenses were higher than its assumed administrative expenses. In this situation, Noble's actual underwriting margin was

Doctors’ Care is an individual practice association (IPA) under contract to the Jasper Health Plan to provide primary and secondary care to Jasper’s members. Jasper’s capitation payments compensate Doctors’ Care for all physician services and associated diagnostic tests and laboratory work. The physicians at Doctors’ Care, as a group, determine how individual physicians in the group will be remunerated. The type of capitation used by Jasper to compensate Doctors’ Care is known as:

The following statements are about a health plan's evaluation of its responsibility centers. Select the answer choice containing the correct statement.

The Rathbone Company has contracted with the Jarvin Insurance Company to provide healthcare benefits to its employees. Under this contract, Rathbone assumes financial responsibility for paying 80% of its estimated annual claims and for depositing the funds necessary to pay these claims into a bank account. Although Rathbone owns the bank account, Jarvin, acting as Rathbone’s agent, makes the actual claims payments from this account. Claims in excess of Rathbone’s contracted percentage are paid by Jarvin. Rathbone pays to Jarvin a premium for administering the entire plan and bearing the costs of claims in excess of Rathbone’s obligation. This premium is substantially lower than would be charged if Jarvin were providing healthcare coverage under a traditional fully insured group plan. Jarvin is required to pay premium taxes only on the premiums it receives from Rathbone. This information indicates that the type of alternative funding method used by Rathbone is known as a:

The Swann Health Plan excludes mental health coverage from its basic health benefit plan. Coverage for mental health is provided by a specialty health plan called a managed behavioral health organization (MBHO). This arrangement recognizes the fact that distinct administrative and clinical expertise is required to effectively manage mental health services. This information indicates that Swann manages mental health services through the use of a:

For a given healthcare product, the Magnolia Health Plan has a premium of $80 PMPM and a unit variable cost of $30 PMPM. Fixed costs for this product are $30,000 per month. Magnolia can correctly calculate the break-even point for this product to be:

The Lindberg Company has decided to terminate its group healthcare coverage with the Benson Health Plan. Lindberg has several former employees who previously experienced qualifying events that caused them to lose their group coverage. One federal law allows these former employees to continue their group healthcare coverage. From the answer choices below, select the response that correctly identifies the federal law that grants these individuals with the right to continue group healthcare coverage, as well as the entity which is responsible for continuing this coverage:

In order to analyze costs for internal management purposes, the Banner health plan uses functional cost analysis. One characteristic of this method of cost analysis is that it

The Puma health plan uses return on investment (ROI) and residual income (RI) to measure the performance of its investment centers. Two of these investment centers are identified as X and Y. Investment Center X earns $10,000,000 in operating income on controllable investments of $50,000,000, and it has total revenues of $60,000,000. Investment Center Y earns $2,000,000 in operating income on controllable investments of $8,000,000, and it has total revenues of $10,000,000. Both centers have a minimum required rate of return of 15%.

One difference between the RI method and the ROI method is that

AHIP Certification | AHM-520 Questions Answers | AHM-520 Test Prep | Health Plan Finance and Risk Management Questions PDF | AHM-520 Online Exam | AHM-520 Practice Test | AHM-520 PDF | AHM-520 Test Questions | AHM-520 Study Material | AHM-520 Exam Preparation | AHM-520 Valid Dumps | AHM-520 Real Questions | AHIP Certification AHM-520 Exam Questions