For Registration of Charitable Trust an application should be submitted with Covering Letter, Court Stamp of ___________ and Certified True Copy of Trust Deed. The application should be made within _________ of creation of Trust. The application should be in Form as specified in _____________ under ____________ and duly notarized.

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. The said rent is

According to ________________ of the Indian Trusts Act, a Trust may be created for any lawful purpose.

As per Section 164(1) a trust for the benefit of an unborn person is liable to income tax at maximum rate of Income Tax, currently_________.

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be __________.

For 2012-2013 the annual exclusion amount sheltered from estate tax in US is ____________.

Employees Provident Fund is applicable to firms employing over _______________ employees

In order that a claim for partition has to be recognized under the Income Tax Act, the claim for partition must fulfill the condition as laid down in ____________ of Hindu Succession Act,1956.

In case of Loss of Thumb, what is the Percentage of Compensation given (as per Workmen’s Compensation Act)?

A trust which is created and operating during the Grantors lifetime is called________________

Individuals who receive employment income in Singapore and who are tax residents of countries that have concluded double tax treaties with Singapore may be exempt from Singapore income tax if their period of employment in Singapore does not exceed a certain number of days, usually _______ in a calendar year or within __________ and if they satisfy certain additional criteria specified in the treaties.

______________ of the Transfer Property Act permits the transfer of property only to one or more living persons.

With respect to the Income Tax Structure in Singapore, if the income of an individual is below______________ the tax rate is 0%.

Mr. Arun mortgages a certain plot of building land to Mr. Sumit and afterwards erects a house on the plot. For the purpose of his security, Mr. Sumit is entitled to ______________.

Where an estate is liable to Inheritance Taxes, the tax is usually payable within ________________ of the end of the month in which the death occurred. If it becomes overdue, the amount owing may incur interest, currently at ___________ (as at April 2012).

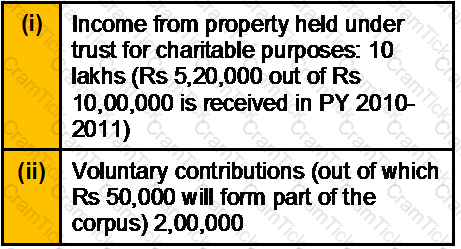

Shri Ganjarwala Charitable Trust (Regd.) submits the particulars of its income/outgoing for the previous year 2009-2010 as below:

The trust spends Rs. 2,77,500 during the previous year 2009-2010 for charitable purposes. In respect of Rs. 5,20,000, it has exercised its option to spend it within the permissible time-limit in the year of receipt or in the year, immediately following the year of receipt.

The trust spends Rs. 2,00,000 during the previous year 2009-2010 and Rs. 1,00,000 during the previous year 2010-2011.

Compute the tax payable on the income of the trust.

The legal heir of the deceased who receives family pension is allowed a standard deduction from such family pension received to the extent of:

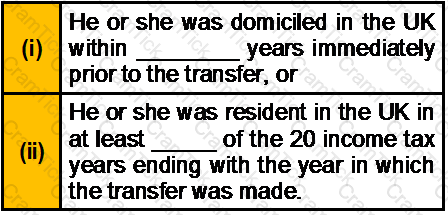

For inheritance tax purposes, even if the individual was not at the time of transfer domiciled in the UK, he or she will be treated as domiciled in the UK if, at the time a transfer of value was made:

A Henson Trust in Canadian law, is a type of trust to benefit _________________

Under the provisions of Section 6 of the Hindu Succession Act, 1956, where a Hindu male dies intestate on or after ______________, having at the time of his death an interest in a Mitakshara coparcenary property leaving behind a female heir of the class I category, then his interest in the coparcenary property shall devolve by succession under that Act and not by survivorship?

Muslim law recognizes that person cannot dispose of by Will more than ______of the net assets (unless ratified by all the heirs of the person leaving behind the Will) while the remaining _________ should be made available for distribution among the heirs.

In case of Amputation through shoulder joint, what is the Percentage of Compensation given (as per Workmen’s Compensation Act)?

You are an Estate Planner. Your Client asks you that if he wants to give business to his children which method is not appropriate. He further asks you which method can help him control the size of this gift through his will. Your reply would be___________

Where a transfer of value is from a UK-domiciled spouse to a non-UK domiciled spouse, then the exempt transfer is limited to ________. For annual exemption, each individual can transfer an exempt amount of up to________ per year.

If the NPV of buy alternative is Positive and the NPV of incremental lease effect is negative then the correct decision is to___________.

As per the ESI Act, the monthly wage limit for coverage is _____________ per month.

You have just started your Estate Planning firm. Your friend who is into Estate Planning since 5 years explains you that an Ideal Estate Planning Prospect is one who is aged ___ or over and are _______________.

High Net Worth Individuals can dispose of their money in______ ways. From the standpoint of the wealth holder,__________ is the most important of all.

Hire Purchase System was developed in ___________. Hire purchases are commonly used by businesses (including companies, partnerships and sole traders) in ________ to fund the purchase of cars, commercial vehicles and other business equipment.

What would be the tax liability if tea and snacks are provided in the office after office hours?

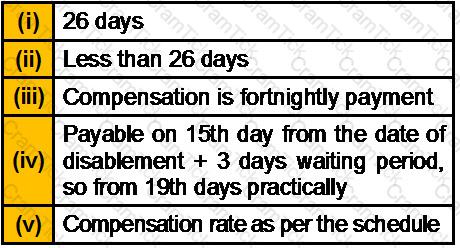

With respect to Workmen’s Compensation Act, if distinction is made on the ground of duration of incapacity it may extend to

The income of any university or other educational institution existing solely for educational purposes and not for the purposes of profit is exempt under clause (iiiad) of Section 10(23C) if the aggregate annual receipts’ of such university or educational institution do not exceed

As per Gift Tax Act of 1958, a gift in excess of _________ received by anyone who is not your blood relative is taxable.

The interest payable for a housing loan outside India is not allowed as a deduction U/S 24 (1) while computing the income from house property. The given statement is

A member is defined under ___________ of the Societies Registration Act and a Governing body is defined under_______________ of the Societies Registration Act.

Mr. Sumit has worked in a PSU for 14 years 7 months. His Terminal Wages are Rs. 45,000. He wants to know the Gratuity amount payable to him (assuming that he leaves the service today). It is_____________

A trust created under the Married Woman Property Act, is an example of ________________.

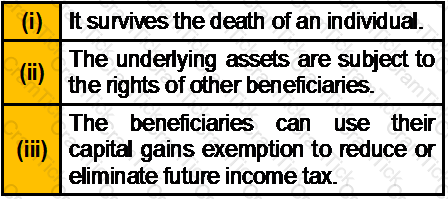

Which of the following is/are ancillary benefit(s) of Discretionary Family Trust?

______________ of the Income Tax Act provides for the registration of a Charitable Trust. _____________ of the Income Tax Act contains the provision that the profits and gains of the business carried on by a charitable trust would be fully exempt from tax if it is attains the objects of the trust.

__________ is an influential person who knows you favorably and agrees to introduce or recommend you to others.

_________ is the most appropriate method for donors who prefer to make gifts at the end of their life and _________ is the most appropriate method for donors who prefer to give gifts during their lifetime.

AAFM Certification | CTEP Questions Answers | CTEP Test Prep | Chartered Trust & Estate Planner® (CTEP®) Certification Examination Questions PDF | CTEP Online Exam | CTEP Practice Test | CTEP PDF | CTEP Test Questions | CTEP Study Material | CTEP Exam Preparation | CTEP Valid Dumps | CTEP Real Questions | AAFM Certification CTEP Exam Questions