Financial Strategy

Last Update Jan 31, 2026

Total Questions : 393 With Methodical Explanation

Why Choose CramTick

Last Update Jan 31, 2026

Total Questions : 393

Last Update Jan 31, 2026

Total Questions : 393

Customers Passed

CIMA F3

Average Score In Real

Exam At Testing Centre

Questions came word by

word from this dump

Try a free demo of our CIMA F3 PDF and practice exam software before the purchase to get a closer look at practice questions and answers.

We provide up to 3 months of free after-purchase updates so that you get CIMA F3 practice questions of today and not yesterday.

We have a long list of satisfied customers from multiple countries. Our CIMA F3 practice questions will certainly assist you to get passing marks on the first attempt.

CramTick offers CIMA F3 PDF questions, and web-based and desktop practice tests that are consistently updated.

CramTick has a support team to answer your queries 24/7. Contact us if you face login issues, payment, and download issues. We will entertain you as soon as possible.

Thousands of customers passed the CIMA Financial Strategy exam by using our product. We ensure that upon using our exam products, you are satisfied.

Company Y plans to diversify into an activity where Company X has an equity beta of 1.6, a debt beta of zero and gearing of 50% (debt/debt plus equity).

The risk-free rate of return is 5% and the market portfolio is expected to return 10%.

The rate of corporate income tax is 30%.

What would be the risk-adjusted cost of equity if Company Y has 60% equity and 40% debt?

Company Z has identified four potential acquisition targets: companies A, B, C and D.

Company Z has a current equity market value of $590 million.

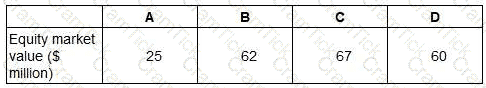

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

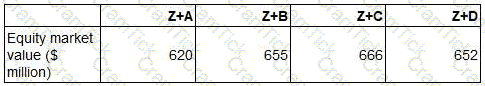

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

A company has a cash surplus which it wishes to distribute to shareholders by a share repurchase rather than paying a special dividend.

Which THREE of the following statements are correct?