Which of the following is a ratio that is often used by commercial banks to measure a company’s leverage and does not include the effect of assets that are difficult to value or are NOT easily converted to cash?

One reason for using a sale and lease-back arrangement in lease financing is to:

During the 1970s, many companies instituted dividend reinvestment plans (DRIPS). There are many benefits of this plan. What is the one negative aspect?

A multidivisional domestic company with centralized treasury decision-making can potentially utilize intra-company lending to:

Company A is a large public company with annual revenue of $1.2 billion and high fixed costs. Its stock is listed on the New York Stock Exchange. Company B is a mid-sized company with annual revenue of $100 million and low fixed costs. Its stock is listed on the NASDAQ. Which of the following statements is MOST LIKELY to be true when comparing Company A and Company B?

A pizza restaurant chain maintains separate accounts at bank branches near each of their 1,067 restaurants to handle the deposit of cash received. Early each morning, the company’s point-of-sale system electronically transmits collection totals from the previous day to its main computer. ACH debits are then initiated to concentrate the funds from the local accounts to the concentration account the following day. Recently, several of the ACH debits have been returned for insufficient funds because deposits weren’t being taken to the bank on a timely basis by the local employees. Without increasing staff at the restaurants, what could Treasury do to prevent this from happening and avoid overdrafts at the local banks?

Company XYZ sends an ACH debit file valued at $300,000 with an average item value of $1,000. The file settlement date is March 10. The file contains no duplicate items and items are split equally between corporate and consumer items. One percent of consumer items and 2% of corporate items were returned. What would be the final net settlement value for Company XYZ?

Company X has a rating that is below investment grade. The treasurer would prefer to use commercial paper for its short-term financing needs and has a commitment from its bank to provide a standby letter of credit. What costs would be associated with this process?

XYZ Company has one inventory supplier, and title to inventory is transferred to the company during the manufacturing process. Which of the following BEST describes XYZ’s relationship with its supplier?

If a company has $126 million in debt at an average cost of 7% and $234 million in equity at a cost of 11%, what is its weighted average cost of capital, assuming a marginal tax rate of 35% and a risk-adjusted rate of 13%?

A company has a line of credit and a bond trustee agreement with a bank. To prevent a decline in the company’s bond rating from having a negative impact on the company’s line of credit, the bank should have which of the following in place?

Merchant MNO’s sales for the day total $20,000. Fifty percent are credit cards, split between Card Red and Card Blue respectively, at 65% and 35% of the card volume. The average ticket is $50. Fees paid are 2% for Card Red and 2.5% for Card Blue and a fee of $0.05 per transaction. What are the fees that MNO will pay to the issuing banks?

In which of the following international cash management methods is title for goods transferred for intercompany sales?

ASC Topic 815 (FAS 133) is applicable when accounting for which of the following?

Which of the following must be considered when designing the basic framework for a cash management system?

A large, nation-wide, retailer of plumbing fixtures is considering implementing ACH technology to improve its accounts receivable processing. Which of the following pre-authorized ACH transactions can the company use for this application?

Which function involves evaluating alternative projects in relation to one another and in relation to the company's cost structure?

When a project has an initial cash outflow with cash inflows in subsequent years, what decision model is most applicable to use to evaluate the adequacy of the project?

A large mature company with limited growth opportunities (positive NPV projects) achieved abnormally high profits this year. After paying mandatory principal, interest, and taxes, the company has $200 million in surplus cash on hand. Assuming its investor base is most concerned with capital appreciation, which of the following is the BEST option for the company?

A put option on a company's stock has an exercise price of $20. On the delivery date, the stock is trading at $24 per share. What should the investor who has paid $2 for the option do?

A French company conducts business strictly within the euro zone (the EMU). Which type of risk is of LEAST concern?

A U.S. based multinational company is filing its U.S. tax return and notes that its U.K. subsidiary had pre-tax income equal to $1 million. The U.K. subsidiary paid an effective tax rate on this income of 40%. If the U.S. tax rate is 34%, what will be the amount of the foreign tax credit on the U.S. tax return related to the U.K. income?

Company X, a US based multi-national, is exploring the option of locating a subsidiary in another country where there has been some historical risk of expropriation of local assets of foreign corporations. Therefore, as part of the risk assessment process the company must specifically quantify the:

A publicly traded company is looking to fund its next project with the issuance of stock. The company’s stock is primarily held by a small group of investors. The company is concerned that issuing stock may upset these investors because it would dilute their holdings. Which of the following strategies would help address the investors’ concern?

The combination of difference in condition (DIC) insurance and umbrella insurance:

An instrument that gives the right to buy a stated number of shares of common stock at a specified price is known as:

A large multinational company with multiple autonomous operational entities is MOST LIKELY to operate.

Which of the following are treasury management objectives?

I. To meet obligations in a timely manner

II. To minimize holdings in non-earning cash balances

III. To monitor and assist in the control of financial risk

IV. To evaluate costs and benefits of capital projects

What does a company with a restrictive current asset investment strategy typically have?

To strengthen outside auditor independence with regard to publicly held companies, the Sarbanes-Oxley Act requires that:

The first step in the financial institution and financial services provider (FSP) selection process should be:

A treasury employee of Company XYZ is privy to financial reporting information yet to be released to the public. He knows that year-end earnings exceed last year’s and would be viewed as positive to the investment community. He casually mentions to a relative that now would be a good time to buy the stock of Company XYZ. Which section of the treasury code of ethics would typically be violated by such a disclosure?

Which of the following is NOT a key area to consider when establishing treasury policies?

A main characteristic of a company with regional offices using a centralized treasury function is:

Under Section 404 of the Sarbanes-Oxley Act, management must state its responsibility for which of the following?

An employer wishing to reduce operating income volatility would MOST LIKELY offer what type of retirement option to its employees?

An accounts payable manager has been mandated to accept all trade discount opportunities with an effective cost of discount above 25%. An invoice has been presented and approved for payment with terms of 3/5, net 30 days. What is the difference between the effective cost of discount offered, and the 25% rate set by the company?

To arrive at today’s projected closing cash position, a cash manager starts with:

A multinational company may use which of the following to locate profits in subsidiaries in low-tax countries?

A public company’s risk profile is currently in balance. The management’s mission statement is to minimize stock devaluation. However, it is forecasting a need for working capital in the short term. Which of the following solutions would BEST assist management in accomplishing its mission?

The exchange of a fixed interest rate cash flow for a floating interest rate cash flow with both interest rates in the same currency is an example of:

A seller’s cost of capital is 12%. The average credit sale is $200,000, and the credit terms are 2/10, net 30. What is the present value of receiving full payment on day 30?

A national retailer’s cash management system includes a field deposit system using multiple banks. To limit the impact of a failure of one of these banks, a cash manager should:

Which of the following trade payment methods virtually eliminates the seller's credit risk?

An auto manufacturing plant in Michigan has high scheduled demand for its product. If the company does not have a long-term contract for raw materials, what type of exposure could it face?

The PRIMARY difference between defined benefit and defined contribution pension plans is whether the employee or the employer:

A company expects the U.S. dollar to depreciate in value compared to the British pound. The company will have a British pound payment to make in five months. The company would MOST LIKELY buy:

XYZ Company is considering selling treasury stock but is concerned about the amount of capital it will raise given the current high volatility of the stock market. What is the BEST strategy a firm can employ to reduce its uncertainty?

All of the following statements are true about adjustable-rate preferred stocks EXCEPT:

An arrangement in which a borrower makes periodic payments to a separate custodial account that is used to repay debt is known as a:

When evaluating a FSP during the RFP process, a company should place a high value on a FSPs financial strength when the provider:

Which of the following will directly increase a company's cost in a fee-only bank relationship?

The earnings allowance rate applied to collected balances is usually determined by which of the following rates?

I. Banker’s acceptances

II. Commercial paper

III. U.S. Treasury bills

IV. Federal agency securities

Which of the following is the MOST usual ranking, from lowest to highest risk, of the investments listed above?

All of the following factors influence a company's decision to use electronic commerce EXCEPT:

Examples of fixed assets include which of the following?

I. Inventory

II. Treasury bills

III. Forklift

IV. Goodwill

In most countries other than the United States, which of the following is used to compensate banks for services provided?

The relationship between debt and equity in a company's capital structure is called:

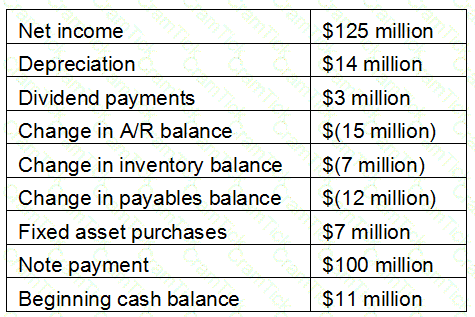

The treasury analyst at RST Corporation has been asked to forecast cash levels for the company’s year-end balance sheet. The analyst has been given the following information:

What should the analyst project as the upcoming year-end cash balance?

Company XYZ has determined that its weighted average cost of capital is 12.5%. The capital structure of the company is made up of 75% equity and 25% debt. The before-tax cost of debt is 10%. Given a tax rate of 34%, what is XYZ's cost of common stock?

A company with constant earnings and excess cash is considering a significant stock repurchase plan. Which of the following is MOST LIKELY to occur?

Which of the following is a common approach to negotiating EDI payment terms versus paper payment terms?

A deck furniture supply company maintains a large inventory during the summer sales season. One of the PRIMARY benefits of this approach is that the company avoids which of the following costs?

MICR encoding errors may be detected by all of the following TMS modules EXCEPT:

A manufacturing company experienced a system failure that lasted more than 24 hours. The company did not have any contingency plans in place and as a result the cash manager was unable to process the following payments:

P-card issuer: $25,000

Payroll: $125,000

Bond interest payment: $200,000

Vendor payments: $260,000

Utilities: $50,000

The cash manager does not have a way to confirm the receivable amounts deposited at the bank. The suppliers are threatening to stop shipments due to the delay in payment and the loss of supplier shipments would threaten the company’s just-in-time production. What concern should the company have?

Kahuna Boards Co. has just experienced a very profitable year and wants to share the success with its shareholders. In order to pay dividends, a sequence of events must occur. Which of the following chronological sequence of events is correct?

1. Stock is sold without the upcoming dividend attached.

2. Dividend is paid.

3. Board of directors announces the dividend.

4. Holders of record are specified.

ABC Company has recently moved away from paper-based invoicing systems and has begun implementing e-commerce solutions. Realizing that its e-commerce implementation may have a negative impact on the float of its trading partners, ABC can do which of the following to help address this concern?

In developing treasury policies and procedures, which activity requires key controls to be in place?

A company’s capital structure includes $800,000,000 in total capital, of which $200,000,000 comes from debt. The firm’s after-tax cost of debt is 6%, and its cost of equity is 12%. The marginal tax rate is currently 40%. What is the company’s weighted average cost of capital?

For newly issued debt, a company’s effective cost of debt is a function of yield to maturity and:

Which of the following should be considered in the design of a collection system for a supermarket or retail store that does not offer proprietary credit cards?

I. Coin and currency handling

II. Debit card acceptance

III. Retail lockbox

IV. Third-party credit cards

A U.S. bank regularly transmits international payments to European based XYZ Bank. The payments flow through an intermediary bank. Recently regulators audited the intermediary bank and discovered the bank may be unknowingly facilitating illegal activities. What payment method was MOST LIKELY used?

Companies following an aggressive strategy for financing working capital and other assets have higher risk due to which of the following?

The main objective of a company's international cash management function is to:

Because of the growing demand in China for oil, a transportation company decides to assume a long position on oil in hopes of generating short-term investment income. Which of the following describes the firm’s strategy?

Which of the following factors would the cash manager consider when deciding whether to make a payment via Fedwire or ACH?

1. Cost of the payment

2. Payment due date

3. Availability of customer's funds

4. Loss of float

Which of the following services allows a single account to be used by a company with multiple units?

On a company’s financial statements, an increase in accounts receivable is reflected as a(n):

In a large company, the financial planning function typically falls directly under the responsibility of the:

Included in the CAMELS rating system for financial institutions are all of the following EXCEPT:

Each of the following statements is true of both defined benefit plans and defined contribution plans EXCEPT:

Which agency appoints the chairman and members of the Public Company Accounting Oversight Board?

A company has transferred all treasury functions to a new office overseas. When preparing the disaster recovery plan, the treasury manager seeks to identify the mission critical functions and then determine what risks the plan should address. Which of the following risks should be the focus of the Disaster Recovery Plan?

A fast-food chain uses corn as an ingredient in its products and wants to hedge its price for corn purchases. It purchases a call option to buy 1,000,000 bushels at $4 per bushel. Assume that the company will pay a premium of $0.10 per bushel or $100,000 to get into the contract. Suppose the price of corn falls to $3.80 per bushel, what is the BEST course of action for the company?

Ensuring that a message was not modified in transit and that stored information has NOT been improperly modified or deleted is referred to as:

In terms of targeting a company’s capital structure, when is it beneficial to assume a high level of financial risk?

Which is the MOST expensive capital structure for a growing technology firm? Assume a tax rate of 32%.

A retail company issues shares of its stock through a full-underwriting arrangement with an investment syndicate of three banks. The lead-left bank is concerned about parties within the syndicate acquiring material nonpublic information (MNPI) concerning the issue. Which of the following would be considered a conflict of interest related to MNPI?

A subsidiary of a large multinational organization was set up in an Asian country. The controller of the organization wants to determine the functional currency of the subsidiary. Which statement correctly describes what determines the functional currency of the subsidiary?

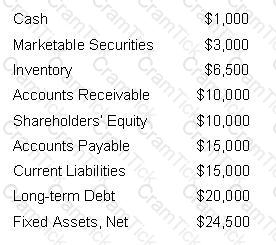

BF Company, a manufacturer of food products, reported financial information shown in the Exhibit for the end of the year. BF Company is subject to covenants in its commercial paper program. It is in compliance with which of the following?

Which of the following is MOST LIKELY to have a significant impact on the financial condition of an organization?

A dealer is selling securities to a client. What is the yield/price at which the dealer will sell?

The seller’s cost of capital is 12%. The average credit sale is $200,000, and the credit terms are 2/10, net 30. What is the seller’s net benefit (loss) if the buyer takes the discount and pays by day 10?

Which of the following should NOT be a consideration when setting an optimal dividend policy?

Which of the following are examples of covenants in loan agreements?

I. Financial ratios

II. Corporate resolutions

III. Borrower limitations

IV. Borrower obligations

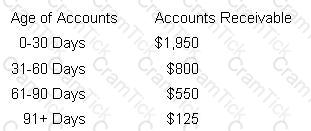

A company has average monthly sales of $2,700, of which 5 percent is on a cash basis, with the remaining sold on open account. The company's accounts receivable aging schedule at the end of March is as follows:

What is the company's DSO?

Three college roommates open a fast-food restaurant chain after graduation. They decide to offer a 401(k) plan to all of their 700+ employees and a defined benefit retirement plan for themselves and their six Group Vice Presidents. If the company initially funds the defined benefit plan with $10 million and is in the 32% tax bracket, what is the after-tax cost of the funding?

Multi-divisional or multi-subsidiary companies have opportunities to optimize their working capital position and overall liquidity by doing which of the following?

ACCOUNTS RECEIVABLE AT THE END OF MARCH

On the basis of the accounts receivable balance pattern above and April sales of $600, the cash flow forecast for April is:

A trader of ABC Bank executed and audited his own trades. Assigning these two functions to the same person introduced which one of the following risks to the bank?

The delay between the time a check is deposited and the time the company's account is credited with collected funds is known as:

Refer to the following information about a company at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%.

What is the company's long-term debt to total capitalization ratio?

When a company must determine the optimal mix of long-term borrowings versus common equity, it is making which of the following types of corporate financial decisions?

Which of the following credit terms would be MOST appropriate for a seasonal product that a manufacturer wants to sell to a retailer during the product's off-season?

What type of insurance provides payments to an organization if it is unable to continue operations for some period due to an unforeseen event?

A treasurer is evaluating a project that will cost $1,000 but will return cash flows of $225, $225, $300, $750, and $750 in years 1 through 5, respectively. The company’s interest rate on its debt is 10% and its marginal cost of capital is 15%. What is the Net Present Value (NPV) of this project?

A company offers credit terms of net 40, with an opportunity cost of 12% to a customer. What discount would have to be offered for the customer to be indifferent between paying on Day 40 and paying with the discount on Day 10?

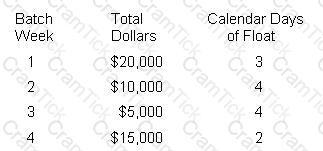

The lockbox receipt records for one 30-day month are provided below. The opportunity costs are 10%.

What is the annual cost of float rounded to the nearest dollar?

What type of tax does a multinational auto manufacturer commonly pay in foreign countries at each stage of a vehicle’s production?

All of the following staff would be involved in the evaluation of an outsourced accounts payable solution EXCEPT:

The analysis of a company launching an initial public offering includes disclosure of information that may interest investors. It also includes confirmation that financial statements reflect true value under GAAP and other pertinent areas of a company’s operations. What is this analysis known as?

Which of the following is considered an important factor when selecting a financial service provider?

A short-term bank line with $20 million of unused capacity and an investment in an overnight money market fund are both forms of which liquidity requirement?

Multinational corporations repatriate funds from foreign operations through which of the following?

In predicting collections from credit sales, a cash manager can obtain prior period information from which of the following sources?

I. Customer payment histories

II. The company's concentration bank

III. The accounts receivable department

IV. The accounts payable department

LLZ Company manufacturers metal detectors in California at a cost of $9 per unit. The most expensive component to make is the sensor which goes in the finished product. The cost is $5 per sensor. Last month LLZ acquired a company in Mexico that makes the sensors for $1 per sensor. LLZ plans to move all sensor manufacturing operations to the factory in Mexico. What is the movement of this cost saving process called?

A company can dispute any check alterations within how many days after the bank statement has been sent?

A nationwide discount retailer is re-evaluating financing methods since the most-popular and most-expensive electronics “must-have” item for this year is set to ship from factories in China. Which of the following credit facilities would be MOST effective for the retailer to use?

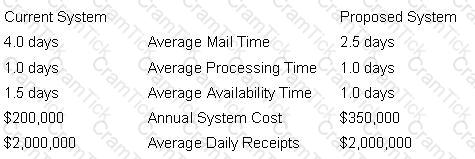

Based on the above information,

if the company uses the trade-off theory in considering its WACC, how will it finance its growth?

If a company does not have cash available to make an interest payment on a bond, the company is experiencing difficulty with its:

In the event of bankruptcy and the subsequent liquidation of issuer's debt, in what order, from first to last, will the following be repaid?

1. Senior secured debt

2. Senior subordinated debt

3. Junior secured debt

4. Junior debentures

XYZ Company has decided to transition the responsibility for its hedging activities from the local offices to the head office; however, the local offices will continue to choose their own depository banks. Under the new structure, XYZ’s treasury operations will be:

Which of the following would MOST directly affect a company’s dividend policy?

A multinational corporation has a successful subsidiary in a country that taxes cross-border dividend payments at 72%. Collections on accounts receivable average 90% per month, and the average rate on local government bond investments is 2.5%. What would be the BEST method for the company to repatriate local profits?

Improvements to the cash flow timeline from a selling company’s perspective would include:

A U.S. company has a secured committed line of credit of $5 million. The company successfully transmitted a $5.5 million wire transfer instruction out to the bank. The bank contacted the company and informed it that the wire transfer would not be processed. What is the MOST LIKELY reason the bank gave the company?

A-Plus Company has made arrangements for a new insurance broker to provide products to its employees. Historically, A-Plus Company’s employees made insurance payments via payroll deduction, but the new broker will be collecting payments from employees directly. What will the broker MOST LIKELY use to minimize collection float?

Sign Company and Paint Company have a twenty-year business relationship, and they work together when sending and receiving payments. Sign Company also does a large amount of business with Brush Company, a subsidiary of Paint Company. Brush Company’s Treasurer recently received a memo from the Treasurer of Paint Company reminding it that when dealing with vendors, extensive information is required when receiving or making ACH payments. What ACH payment format are Sign Company and Paint Company MOST LIKELY to use?

A company with high operating leverage reduces its average cost per unit by 20% as its sales volume increases by 40% annually. This an example oF.

What do MOST companies try to maintain due to the signaling effect and clientele effect?

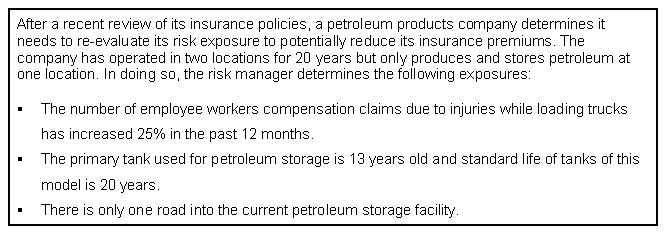

Given the above information,

if the risk manager adds a tank at its second facility, what loss control technique is being used?

Which section of the statement of cash flows includes items that represent the cash inflows and outflows related to the daily functions of a company?

BEA Company has determined its breakeven dollar amount for concentrating remote funds is $550.00. BEA Company has a daily earnings rate of 6% and gains one day of accelerated funds. If a wire costs BEA $35.00 dollars, what is the cost of an electronic funds transfer for BEA Company?

The treasury manager of an auto-parts manufacturer has noticed that checks were sent to a foreign individual not on the approved vendor list. The payables manager has explained the payments but did not provide an invoice. The treasury manager did no further research and is later disciplined for:

A company is filing for bankruptcy protection and is concerned about the welfare of its sizeable retiree population. Under ERISA, it is obligated to perform which of the following actions regarding its defined benefit plan?

Under which of the following circumstances is lengthening the disbursement mail float NOT a benefit to the disbursing company?

One example of increased use of electronic payments for retail businesses to convert customer checks to cash at the counter more quickly is:

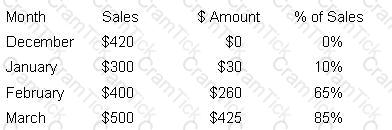

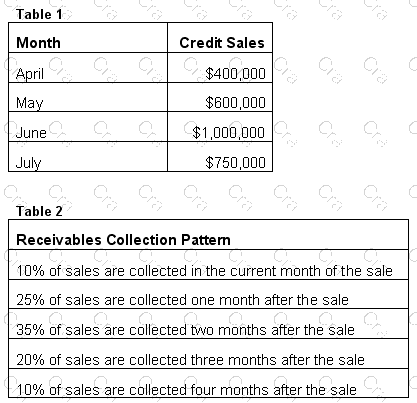

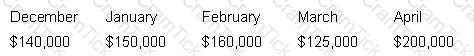

The company's monthly credit sales are in Table 1 and its receivables collection pattern is in Table 2. If this company wishes to achieve a second quarter (April-June) DSO of 60 days, what would its ending accounts receivable balance need to be?

Assume a 90-day quarter.

A company is considering expanding to a three-site lockbox system from its current two-site system and has collected the following data:

The average collection float in the current system is:

The role of the depository bank in the check-clearing process is typically which of the following?

A cash manager's recommendation to use procurement cards as a way to reduce accounts payable expense is an example of:

The Treasury Department of ABC Corporation has been working hard to prevent external fraud from impacting its operating bank accounts. Recently, they implemented protective services on their disbursement accounts. This morning, the treasury analyst realized that an expected sales tax payment to the state of Maryland had not occurred. The analyst knew that it had been successfully initiated yesterday. Which service used by the corporation may need to be adjusted to pay the state of Maryland?

Following the latest round of cost-cutting measures at ABC Corporation, the Treasury Department retained a headcount of 2 individuals. While the analyst was out sick, she gave her password to her Manager so that payments could be released via the bank’s wire transfer system. The Manager sent 3 wires out with incorrect banking instructions. The problem was not identified until the angry suppliers called several weeks later demanding payment. The corporation has not yet recovered the $130,000 sent to erroneous accounts. In this instance, which control failed for ABC Corp.?

When a buyer receives goods, but payment is not due to the supplier until some later date, this is defined as:

A portfolio manager’s investment policy states that they are not allowed to hold any investments that have extension risk. Which type of investment should the portfolio manager avoid?

For ABC Company in the last fiscal year, the operating profit was $8,500,000, the tax rate was 33%, the total capital was $75,000,000, and the WACC was 9.7%. What was the EVA for ABC?

A manufacturing company selling engines and other mechanical equipment, with invoices averaging $15,000, would use which of the following systems?

Kensley Biscuit Company Ltd. decides to invest £125,000 in new packaging equipment to help it keep up with increased demand. As a result of this investment, the company’s annual profit improves by £11,763. If Kensley’s cost of capital is 8.25% and its corporate tax rate is 42%, what is its residual income (RI) from the investment?

Using a digital certificate when accessing a financial services provider is one way to reduce what kind of risk?

A nationwide retailer has been making EFT payments to its suppliers for several years. It will expand its processes to include consumer payments in its EFT initiative. Which of the following will support this initiative at the point-of-sale?

Which of the following would be considered insurance risk management services?

Private companies usually go public by making an initial public offering. What is the term for offering subsequent shares in the market?

Company XYZ is conservative when investing in their short-term portfolio. XYZ is looking to add the following money market instruments in their own country: a reverse re-purchase agreement, a floating-rate note, and a negotiable certificate of deposit. What types of investment risks are associated with these instruments?

A company can use all of the following documents to establish a relationship with a bank EXCEPT:

To increase the money supply, the Federal Reserve would increase which of the following?

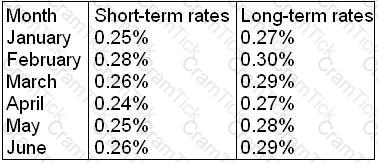

A company has decided to manage its short-term investment portfolio in-house. It is looking for enhanced capital gains as well as the ability to sell the instruments on the secondary market at a premium. The investment manager has forecasted the interest rates shown below:

Which investment strategy should be employed by the company?

Each month, Company ABC expects to make approximately 1,000 payments through its main bank to a group of suppliers who accept electronic payments but who refuse to pay interchange fees. If the suppliers' payment terms are net 30, and Company ABC wishes to pay as close to the payment due date as possible, with the lowest risk and cost, which payment method should it choose?

A recent investigation by a major news network discovered that the management of a company has been actively working to inflate short-term profits in order to increase their bonus payout at the expense of long-term profits. Management actions are an example of an:

A treasury analyst is working with the fraud and risk department to investigate suspicious payments. After collecting the analysis, the analyst presents the results to the fraud and risk department. What role is the treasury analyst fulfilling in treasury management?

Which of the following are primary objectives of cash forecasting?

I. Managing liquidity

II. Optimizing float

III. Enhancing financial control

IV. Minimizing borrowing costs

The treasury analyst has been asked to construct a treasury dashboard that contains borrowing levels, operational cash flow, and current cash account balances. Which of the following sources of data would be MOST efficient for daily dashboard updates?

The time between when the payor mails the check and the payee receives available funds is known as:

A prearranged ACH payment normally includes which of the following?

I. A fixed payment amount

II. A provision for immediate availability

III. A predetermined payment date

Which of the following is true about using an RFI in the financial institution and FSP selection process?

Which of the following would increase if the Fed were to announce a reduction in reserve requirements?

A utility company is evaluating whether or not it should build a new plant. The process of reviewing the quantitative and qualitative factors are an example of which finance function?

A U.S.-based bank finalized an ISDA master agreement with a large Mexican corporation. Subsequently, the corporation entered into a one-year OTC derivative with the bank to hedge against increasing corn prices. Which of the following statements is correct?

Management is concerned with the level of volatility in the company's fixed income portfolio. Which of the following measures will provide management with the MOST comprehensive view of portfolio volatility?

The actions taken by a company regarding crisis management, alternative operating procedures, and communications are referred to as:

A treasury manager is trying to convince management to invest in a treasury management system to help analyze, reconcile, and efficiently manage bank fees. Which of the following is NOT a benefit?

The renegotiation of trade payment terms in an e-commerce environment should include which of the following?

The time from the deposit of a check in a bank account until the funds can be used by the payee is known as:

Which of the following are commonly used for financing accounts receivable?

I. Factoring

II. Issuing credit cards

III. Revolving bank loans

IV. Letters of credit

ABC Company is considering investing in new production technology. ABC has projected that the investment would add $5,000,000 in additional operating profit and that the resulting balance sheet would show $7,000,000 in long-term debt and $11,000,000 in total equity. ABC has a 34% tax rate and a 10% WACC. Which of the following is the investment's EVA?

"Fees" in Country Y, which would be considered bribes in the United States, are ingrained in the commercial culture. A U.S. company doing business in Country Y:

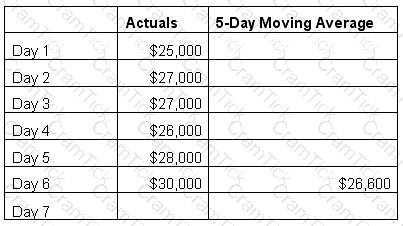

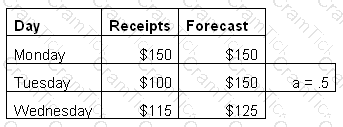

Company XYZ uses exponential smoothing to forecast its daily lockbox receipts. With the help of a statistical computer program, the company has determined that the smoothing constant is 0.35.

Using the data in the table, what is the exponential smoothing forecast for Day 7 (rounded to the nearest whole $)?

A manufacturing company is working to improve its cash conversion cycle. Factory production has increased over the last year to increase inventory levels. They have an inventory turnover of 3.1 and asset turnover of 5.0. The company has a days’ payable of 30 and a days’ receivable of 60. It has started enforcing its net 30 terms and placed customers with balances outstanding more than 45 days on credit hold. As a result, the company collected receivables quicker but it suffered a 10% loss in sales. What can the company do to reduce its cash conversion cycle?

XYZ Company is a fairly new and high growth company funded by venture capital. Which of the following performance measures is it MOST LIKELY to use?

A cash manager is determining the threshold over which cash concentrations will be done by wire. An ACH transaction costs $0.50. A wire costs $12.00. Funds are available 2 days quicker by wire and the opportunity cost of funds is 5%. What threshold should the cash manager use?

XYZ Company has decided to purchase a close competitor. This acquisition would make XYZ Company the 4th largest in its industry allowing it better purchasing power and greater distribution channels. After completing the M&A analysis, it is determined that the combined companies would produce a 40% increase in revenue, reduce manufacturing costs by 30%, but would increase current liabilities by 27%. Which of the following would keep the acquisition from happening?

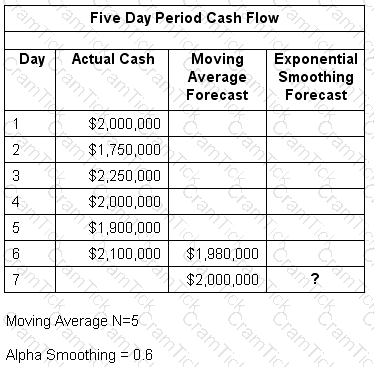

QRT Corporation uses exponential smoothing in its cash flow forecasting model. Five days are used to calculate the moving average forecast.

If the value of the smoothing constant is .60, what is the exponential smoothing forecast for day 7?

A North American service company has autonomous offices in different geographic regions each handling their own sales and accounts receivables deposits to local banks which primarily consist of checks. By implementing a lockbox collection system, what objective in its collection policy would it have met?

A company has a $2 million line of credit requiring a 5% compensating balance on usage. For the next year, the company projects a usage of 75% and a 10.375% interest rate. If the balance requirement is eliminated, by how many basis points will the company's effective interest rate be reduced?

Measurement of a company's liquidity includes the calculation of all of the following EXCEPT:

U.S. dollar-denominated instruments issued by foreign banks through their domestic branches are known as:

On the basis of the data above,

what is the forecast for Thursday's cash receipts, under the exponential smoothing method?

A merchant, wanting to accept credit cards as payment method, will negotiate its fees with which of the following participants?

In order to maintain internal control best practices, how often should an organization reconcile their investment statements?

An investor is interested in acquiring ownership in a firm while ensuring predictable timing and amount of cash flow. Which instrument should the investor choose?

When investing in commercial paper, the investor's primary consideration should be which of the following?

The time between receipt of a mailed payment and the deposit of the payment in the payee's account is known as:

When a subsidiary borrows money, the parent, sister subsidiary, or other entity is often used in order to:

A grocery store chain would be likely to use all of the following services EXCEPT:

The Treasurer of PJB Company is in charge of implementing new treasury management software. Without issuing any RFPs, the Treasurer hires a consulting company to install the software and program it to suit the company’s needs. The Treasurer is responsible for approving the consultant’s invoices for payment. Through conversation, the CFO discovered that the Treasurer’s relative is one of the partners at the consulting company. The Treasurer was immediately terminated. What did the Treasurer MOST LIKELY violate?

Customers of an electronic trading firm are experiencing problems with the online trading platform. The company IT department discovered that although display of market data is in the proper place, there are no tags being used to populate specific information in the necessary fields. The company is MOST LIKELY experiencing a problem with:

Merchant XYZ has $200,000 in sales for the month of December, 60% in cash and the remaining is divided equally between checks and credit cards. One percent of the credit cards were charged back during the month of January. What is the value of sales received by the merchant?

Which of the following is one of the PRIMARY considerations when establishing treasury policies and procedures?

Which of the following would fall under an organization's account resolutions?

In order to control increased vulnerability to financial risk, a treasury analyst has been tasked with completing a policy statement on hedging foreign currency. Within this policy, a PRIMARY exposure that needs to be addressed is:

A company that has a nationwide workforce may use which of the following methods for disbursing payroll to minimize the number of bank accounts?

I. Payable through draft

II. Multiple drawee checks

III. ACH credit transfers

The delay between the time a lockbox site receives a check and the check is deposited is called:

Which of the following is an example of a company's internal data used for cash management?

A U.S. company that is expecting to receive a payment of C$1,000,000 purchased a put option of C$1,000,000 at a strike price of 1.75 C$/US$. Two days before the receipt of the payment, the spot rate is 1.85 C$/US$. To maximize its receipt of dollars, the company should do which of the following?

The PRIMARY objective of the AFP Account Analysis Standard is to help cash managers in which of the following areas?

Which of the following types of payment transactions requires the authorization of both the initiating and the receiving party?

Which of the following items would be classified as a source of cash on a company's statement of cash flow?

I. Selling, general, and administrative expense

II. Increase in accounts payable

III. Increase in inventory

IV. Depreciation expense

An analyst at XYZ United is in charge of setting up the bank accounts. Fraud is a major concern due to the analyst’s past experience with previous employers. The analyst has estimated that the company will earn 3.7% on surplus cash. Surplus cash must be invested in short-term investment grade investments. The company’s closest competitor earned 4.1% for its surplus cash in its latest fiscal year. What bank service should the analyst use to maximize the company's surplus cash?

A U.S. corporation has annual revenues of $500 million and a corporate tax rate of 15%. It has subsidiaries in Country A and Country B. Subsidiary A has annual revenues of $50 million. Subsidiary B has annual revenues of $20 million. The parent company has asked the Subsidiary A to transfer the equivalent of $10 million to Subsidiary B. There is a 5% withholding tax in Country A and a 3% withholding tax in Country B. How much withholding tax will the company owe as a result of this transaction?

The Treasurer at ABC Company currently uses an in-house company-processing lockbox center. The Treasurer has asked for an analysis to determine the major advantage of using a traditional check/mail-based lockbox system. ABC receives 287,000 payments per month and hired seven additional staff members to process the payments in-house. Additionally, $389,000 was invested in the equipment used to process the payments and NSF checks have decreased 7% since using the in-house center. The equipment’s current market value is equal to its book value. What major advantage should the analysis indicate?

RAL Industries is a manufacturing company that currently has locations in the United States and Latin America and has just completed an acquisition of a company located in Europe. As a result of the acquisition, they have a large number of financial service providers. In an effort to reduce the number of providers and services used globally, RAL has decided to develop a formal selection process to consolidate its many global banking services. In order to reduce the amount of time the selection process takes, determine which services providers can offer, and the number of providers involved in the process, what should RAL Industries issue?

Which of the following correctly describes pooling as practiced in the European cash management environment?

In a large company, the person who normally oversees both the treasury and the accounting functions is the:

When a supplier uses evaluated receipts settlement (ERS), which of the following statements is true?

Company RST is a seasonal retailer who has just completed its holiday season and is temporarily flush with cash. The treasurer has identified approximately $15 million of excess balances and is trying to determine what to do with the surplus cash. Cash forecasts show that the funds will be needed in approximately 30 days to replenish inventory. Which of the following plans should the treasurer implement immediately?

A diversified industrial company operates multiple remote manufacturing facilities that manage local supplier relationships. The company draws on a single line of credit for all of its working capital needs. Which of the following types of disbursement systems would BEST meet this company's needs?

An electronics firm realizes that due to adverse events projected over the next 18 months there is a 5% chance that its profits will decrease by $100,000. The company's beta is .08 and its cost of capital is 9%. What approach is the company MOST LIKELY using to determine its level of financial risk?

An equity management company’s Chief Financial Officer and Treasurer are evaluating their corporate investments and decide that they need to diversify their stock holdings to include personal care products companies. Based on their analysis, publicly-traded companies A and B stand out as choices. Company A has a beta value of 0.65 while company B has a beta value of 1.10. They decide to invest in Company A. What objective of their investment policy did they use to make their decision?

The Treasury Manager of a privately held company is looking to finance new equipment that has a useful life of 5 years. What type of financing would the Treasury Manager MOST LIKELY employ to finance the equipment?

An internal auditor discovers that employees can enter and approve their own wire transfers. This practice violates what internal control?

Treasury policies and procedures should outline roles and responsibilities for which of the following activities?

A corporation is considering utilizing ACH transactions for its large value transfers, as opposed to wire transfers. Which of the following would MOST LIKELY deter the corporation from implementing this change?

A U.S. company has 50 bank accounts from which it issues check payments. In order to more accurately determine its daily cash position, which of the following bank services should be implemented?

A company plans to perform an A/R cash analysis based on the following sales information:

60% of sales are collected within two months after the sale. After three months, $135,000 of January's sales has been collected. What was the percentage of January's sales collected in April?

A town has $25 million excess funds to invest long term. The town’s investment policy requires it have full FDIC coverage on all investments. The town is willing to do its own due diligence on the financial institutions that they invest in, but would prefer to have one statement. Which of the following investment options meets its requirements?

What should a company’s senior management consider in their payment policies to eliminate the co-mingling of funds for payables, receivables and foreign exchange transactions?

ABC Company offers a discount of 2/10, net 30 to its customers. ABC factored its accounts receivables with an outside vendor, under a “with recourse” arrangement. What impact might this have on the company?

Which institution or accord was approved in 2009 to strengthen the regulatory capital framework for banks by focusing on minimum capital requirements, supervisory review and market discipline?

Due to a loss of proprietary information held for clients, ABC Company has been named in a billion dollar lawsuit. It was determined that the loss of information was due to a breach in its computer system firewalls by outside parties. When the lawsuit became public, the company experienced a steep drop in its stock price. This scenario is an example of what kind of risk?

An intern was hired by the Vice President of Accounts Payables to process the electronic payments that come through the bank. The intern is responsible for manually entering payee information into the system at each step of the process. The VP directed the intern to enter the information as fast as possible without mistakes to optimize the number of transactions that could be processed. Instead of manually entering information the VP should have utilized:

Company XYZ is a high technology company. It is planning on acquiring another company in the high technology sector. Company XYZ does not have enough cash to acquire the company and is planning on financing the acquisition through a bond offering. Which of the following measures is company XYZ MOST LIKELY to use in its analysis of operating profits considering it is a high debt transaction?

XYZ Company experienced a substantial monetary loss due to over exposure to one particular sector of the stock market. The Treasurer had invested in companies tied to five different sectors, but violated the company investment policy by exceeding a 10% limit for any sector. In developing its investment policy, what should XYZ Company have considered to prevent this scenario?

An electronics manufacturer is attempting to protect itself from financial losses due to projected high warranty claims costs for one of its technically complex products. What kind of assessment should the company perform to determine the appropriate external insurance coverage that would protect it from the claims?

Which of the following is a KEY objective when instituting a collection and concentration policy?

Company ABC experienced a loss in the past when an employee in the treasury department was able to transfer $1.5 million to a personal account offshore. The company is working with a security agent to prevent this from happening in the future. ABC also accepts a large number of checks as payment. The agent has suggested upgrades to ABC’s payment process. What step should be taken to help mitigate this type of risk in the future?

Company ABC is a restaurant chain that has enjoyed a surge in customers’ dining with not much of a profitability increase in the last couple of years. Following a bad restaurant review, customer traffic deteriorated with not much change in profitability. Which of the following BEST describes the cost structure of the company?

A company has been a publicly traded company since 2001. Only 14% of the available stock is sold to the public and traded on the NYSE. The founding family retains control of 86% of the company. The audit committee consists of a CPA, an investment advisor, and two family members. In 2013, the CFO and CEO decided to change the director's code of conduct due to fraud attempts by one of the vice presidents. The vice president is still employed by the company as the stolen check stock was returned. What form is legally required to be filed by the company due to the code of conduct change?

Which of the following objectives of treasury management refers to a company’s ability to meet current and future financial obligations in a timely, efficient, and cost-effective manner?

The MICR encoding on a check provides all of the following information EXCEPT:

What is the MOST appropriate financial plan when a corporation wishes to establish its overall goals and objectives over a period of time?

An airline has entered into an agreement with its partners to offset receivables and payables for a specified period of time and to transmit or receive the difference via funds transfer at the end of the period. This is an example of:

The U.S. government agency that administers and enforces trade sanctions against targeted foreign countries is the:

A multinational company that uses “notional pooling” for its euro zone subsidiaries will realize which of the following advantages?

Racklyn Paint Company, a new paint and construction company, has vendor payables of $2 million due periodically over the next 3 months; payroll payable to its crews of $500K each month; a mortgage of $4.4 million with a fixed rate of 6.0%; and an equipment loan of $5 million with a bank at a 30-day LIBOR plus 150 bp payment of $100K due monthly. Racklyn receives their first contract valued at $12 million with half of the contract value due at the time of contract and final payment upon completion. Racklyn expects the job to last 6 months. Which option would be the BEST use of Racklyn Paint Company’s cash?

ABC Company, a publicly held U.S. multinational, owns several manufacturing plants in Latin America as well as several ships to transport its products globally. 60% of its sales are from its euro-based subsidiaries. The company uses various derivative instruments to mitigate exposure to fluctuations in fuel prices and FX rates. The hedging deals are long-term and placed with many counterparties. ABC Company is also a net borrower and has a syndicated credit facility in place. Which of the following actions to mitigate counterparty risk would MOST benefit the company?

Bank A is to pay Bank B $6,000,000 for 10 transactions that occurred throughout the day. Bank B is to pay Bank C $8,000,000 for 13 transactions that occurred throughout the day. Bank B is to pay Bank A $5,000,000 for 17 transactions that occurred throughout the same day. These banks operate using a gross settlement system. How many transactions will occur between these banks to settle the payments?

A merchant has a chargeback rate of 0.03% on average daily sales of $200,000. After switching to a new merchant acquirer that is a bank, the merchant sees the rate increase to 0.05% or $10,000. The merchant’s analysis reveals that the bank maintains its data warehouse in another country where the system network is routinely hacked. What act or standard is being violated?

Company X has asked its banking partner for a recommendation on which type of bank account would be best if it has excess funds that are not required for daily cash management. The company determined the excess cash flows by using the short-term cash forecasting distribution method. Company X will require a return on these funds. Which account is recommended?

XYZ Bank would like to conduct some foreign exchange transactions with JKL Bank. JKL isn’t the most liquid and could have some credit risk. XYZ Bank should suggest which of the following in order to eliminate risk?

XYZ Company has incurred a financially devastating event because of a hurricane at its offshore manufacturing plant. Due to the impact on liquidity, the company may not be able to survive. What should the Treasurer have done in order to assess the risk associated with this type of event?

Assume the cost of an ACH transaction is $0.80, the charges for a wire transfer are $30.00, the monthly account maintenance fee is $10.00, and the company earns interest at an annual rate of 1.825% on overnight investments. What is the break-even point where the interest earned on overnight investments offsets the incremental wire costs?

A U.S. company’s pension plan is managed by an investment management firm, headquartered outside the United States. The investment management firm outsources the accounting for the plan to an organization on the Office of Foreign Assets Control (OFAC) sanctions lists and the firm does not advise the U.S. company of this fact. A financial loss in the pension plan is later realized due to the mismanagement of funds. When establishing its contract with the firm to protect itself from losses in the pension plan, the company should have:

A hamburger patty supplier receives an order from ABC Burgers located in Minnesota. The supplier’s policy is to bill upon fulfillment of the order and not at delivery. ABC Burgers pays upon receipt of goods. A blizzard has closed the manufacturing facility and roads; delivery will be delayed by two days. Which type of float occurs between the receipt of an invoice by ABC Burgers, including the credit period, and the time ABC Burgers’ account is debited?

Under the standards of corporate governance adopted in 2002, an independent director must:

In an organization with personnel limitations, which of the following strategies should be considered to mitigate cash management system risk?

A multinational company owns a United Kingdom subsidiary that has total assets equal to £1 million and intercompany loans due to the parent company equal to $1 million. It would like to undertake a balance sheet hedge of the U.K. subsidiary’s GBP liability because it expects a depreciation of the pound. Given these circumstances, which of the following actions would be appropriate?

A company is concerned that investor dissatisfaction could lead to a rapid change in its board membership. To prevent this, which of the following strategies should the company employ?

A buyer receives an invoice from a supplier that offers discount terms of 3/10, net 60. What is the effective cost of discount?

Which of the following is true when a company purchases goods using trade credit from suppliers?

The auditors of a private college are examining and auditing the college’s financial statements. The statements are not presented in accordance with GAAP. What should the auditors do?

The treasurer of a corporation is negotiating with one of his/her suppliers to allow the corporation to have 30 days to pay the supplier’s invoices. The treasurer is arranging:

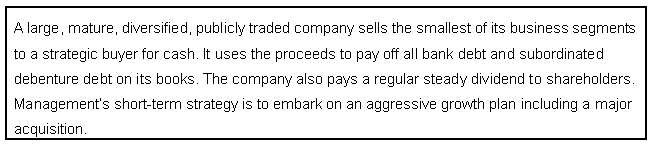

A large mature, diversified. publicly traded company sells the smallest of its business segments to a strategic buyer for cash. It uses the proceeds to pay off all bank debt and subordinated debenture debt on its books. The company believes the stock is trading at a reasonable price and continues to pay a regular steady dividend to shareholders. Management's strategy is to embark on an aggressive growth plan including a major acquisition.

Based on the above information before making the major acquisition, several large institutional shareholders have asked management to consider all of the following EXCEPT:

A company with operations throughout Europe uses banks that do not provide a full range of local banking services. What would be the BEST approach to concentrate cash?

A company has six fraudulent checks clear its primary disbursement account for a total of $7,652. The bank agrees to split the loss with the company to maintain a good relationship. As a condition of sharing the expense, the bank requires the company to establish positive pay on its disbursement accounts or have the company absorb the losses on future fraudulent payments.

What type of risk financing technique is the bank using?

A company with $50 million in foreign assets decides to increase its foreign debt by $40 million for a debt ratio of 80%. This action will reduce which exposure?

Company ABC, with a current debt rating of BBB- from Standard & Poor’s, is negotiating a new revolving credit agreement with its lenders. The company anticipates closing on a small acquisition within a year of executing this new agreement and would like maximum flexibility to determine its capital structure. The company is MOST concerned about the lenders’ inclusion of A.

An employee earning $80,000 per year decides to begin contributing to his company’s 401(k) plan effective January 1st. Assuming he is in the 25% tax bracket, contributes 15% of his pay into the plan each month and receives a company match of $0.50 for every dollar he contributes, what is his taxable compensation that year?

Company ABC has undergone substantial system enhancements in order to take advantage of B2B efficiencies. To encourage its trading partners, ABC has offered a 1.5% discount to those who allow ABC to debit their bank account electronically on the day the product is delivered. The greater number of trading partners who agree to this arrangement, the greater improvement Company ABC will see in its:

Which of the following options would be BEST suited for a firm that wishes to pay no premium?

JMW Company processes its consumer payments using a lockbox provider. On average 35% of its remittance advices contain encoding errors. JMW Company’s cost for the lockbox provider to process these payments will be least impacted if it uses:

Recently LEW Utilities, a local utility company, began using the company processing center method to process customer payments. Prior to this change, it used its local depository bank’s lockbox to process the payments. The PRIMARY advantage of the new method is to:

JKL Company has been successful in shortening the time associated with its mail float, processing float and availability float. JKL Company will experience which of the following as a result of these improvements?

A small regional bank is losing market share in fiduciary services and the CEO has decided to scale back the trust department. Which of the following is considered a core service of a trust department?