Section B (2 Mark)

The tracking error of an optimized portfolio can be expressed in terms of the ____________ of the portfolio and thus reveal ____________.

Section A (1 Mark)

In US which of the following does not count as an itemized deduction on income tax?

Section B (2 Mark)

How much should you pay for a share of stock that offers a constant growth rate of 10%, requires a 16% rate of return, and is expected to sell for Rs50 one year from now?

Section A (1 Mark)

Guarantees covering security deposit/earnest money/advance payment/ mobilization advance etc. would come under__________________ category

Section B (2 Mark)

As Per Article 12 Double Taxation Avoidance Agreement with US, _____per cent of the gross amount of the royalties or fees for included services as defined in this Article, where the payer of the royalties or fees is the Government of that Contracting State, a political sub-division or a public sector company.

Section A (1 Mark)

Minimum number of employees in an establishment for it to come under the purview of the Payment of Gratuity act is ______

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Companies are:

Section B (2 Mark)

How much interest is paid in the 43rd monthly payment interval of a loan for Rs43 200 if the loan is amortized at a rate of 9.75% compounded annually over 7 years.?

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Mehta buys machinery for Rs. 80000 which is to be replaced after a period of two years. The replacement cost at that time will be Rs. 90000. As a Chartered Wealth Manager advice Mr. Mehta now what he should do after two year for the replacement of the said machinery?

Section B (2 Mark)

In UK, which of the following types of income is not specifically exempt from income tax?

Section C (4 Mark)

Mr. XYZ is bullish on Nifty when it is at 4191.10. He sells a Put option with a strike price of Rs. 4100 at a premium of Rs. 170.50 expiring on 31st July. If the Nifty index stays above 4100, he will gain the amount of premium as the Put buyer won’t exercise his option. In case the Nifty falls below 4100, Put buyer will exercise the option and the Mr. XYZ will start losing money. If the Nifty falls below 3929.50, which is the breakeven point, Mr. XYZ will lose the premium and more depending on the extent of the fall in Nifty.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3400

• If Nifty closes at 4800

Section B (2 Mark)

A hired a bicycle from B. The written contract contained a clause which read “Nothing in this agreement shall render the owner liable for any personal injuries to the rider of the machine hired”. Owing to a defect in the brakes of the cycle, A met with an accident and got injured. Can A recover Damages?

Section C (4 Mark)

Suppose an investor Mr. A buys or is holding ABC Ltd. currently trading at Rs. 4758. He decides to establish a collar by writing a Call of strike price Rs. 5000 for Rs. 39 while simultaneously purchasing a Rs. 4700 strike price Put for Rs. 27. Since he pays Rs. 4758 for the stock ABC Ltd., another Rs. 27 for the Put but receives Rs. 39 for selling the Call option, his total investment is Rs. 4746.

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 4851

• If ABC Ltd closes at 5267

Section B (2 Mark)

If an investor strongly believes that the stock market is going to have a sharp decline shortly, he or she could maximize profit by

Section B (2 Mark)

Which of the following two outcomes is an example of Loss Aversion Bias:

Section B (2 Mark)

You are considering the purchase of a quadruplex apartment. Effective gross income (EGI) during the first year of operations is expected to be Rs33,600 (Rs700 per month per unit). First-year operating expenses are expected to be Rs. 13,440 (at 40 percent of EGI). Ignore capital expenditures. The purchase price of the quadruplex is Rs. 200,000. The acquisition will be financed with Rs60,000 in equity and a Rs. 140,000 standard fixed-rate mortgage. The interest rate on the debt financing is eight percent and the loan term is 30 years. Assume, for simplicity, that payments will be made annually and that there are no up-front financing costs.

What is the overall capitalization rate?

Section C (4 Mark)

Singhvi group has recently announced that expected dividends for the next three years will be as follows:

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Section C (4 Mark)

The Puri’s family includes a financially well-informed couple, both aged 34, and two children aged 4 and 6. They are financially sound, but were not in the market during the Indian Bull market of the 2003 to 2007 as many of their neighbors were. The couple’s total income, Rs. 12,00,000, which they do not expect to grow significantly in times to come

They have saved 15,00,000, which they hope will be the financial foundation from which they will send their children to college and retire comfortably.

Which of the following biases does the Puri Family suffer from:?

Section B (2 Mark)

If an investor determines that next year’s earnings estimate is Rs2.00 per share and the company subsequently falters, the investor may not readjust the Rs2.00 figure enough to reflect the change because he or she is “anchored” to the Rs2.00 figure. This is not limited to downside adjustments—the same phenomenon occurs when companies have upside surprises

Which of the following Biases have been exhibited by the investor?

Section C (4 Mark)

Read the senario and answer to the question.

Sajan and Jennifer want to accumulate funds for their vacation expenses as per their determined goal. They want to invest a fixed amount immediately from the Bonus amount he has received, and then in the beginning of every financial year till April, 2020 in a separate scheme of an Equity Mutual Fund. He would withdraw the required amount annually as adjusted for inflation from the Scheme from April, 2021 till April, 2036 for undertaking vacation trips. What approximate amount should be invested every year to achieve this goal?

Section C (4 Mark)

Read the senario and answer to the question.

Vinay has come across two projects, each with a 12% required rate of return and under given cash flows:

If the projects are independent, you being a CWM® would advise Vinay to:

Section C (4 Mark)

A share pays nil dividend and its current market price is Rs.100. The possible selling prices at the end of a year and the probabilities are:

What is the expected rate of return at the end of the year?

Section B (2 Mark)

Which of the following is a reasonable assumption to make about the understanding of a client on the Wealth planning Process?

Section B (2 Mark)

Which of the following statements regarding a buy and hold strategy are true?

Section B (2 Mark)

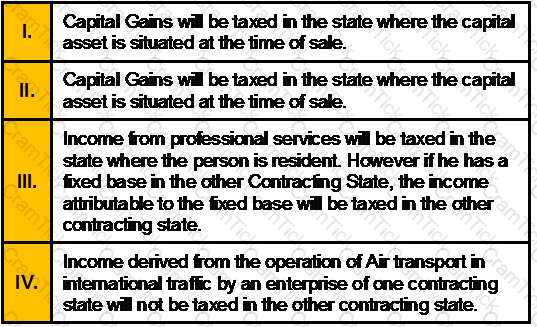

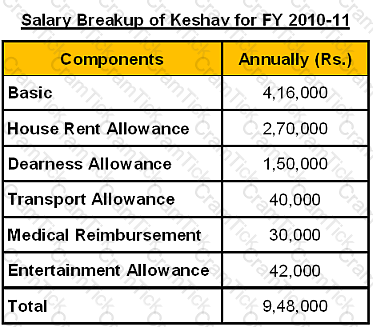

Which of the following statements with respect to DTAA is/are correct?

Section A (1 Mark)

Which portion of his property can a muslim normally be guest according to muslim personal law?

Section C (4 Mark)

Dinex Ltd, a leader in the development and manufacture of electronic devices, reported earnings per share of Rs 2.02 in 2003, and paid no dividends. These earnings are expected to grow 14% a year for five years (2004 to 2008) and 7% a year after that. The firm reported depreciation of Rs 2 million in 2003 and capital spending of Rs 4.20 million, and had 7 million shares outstanding. The working capital is expected to remain at 50% of revenues, which were Rs 106 million in 2003, and are expected to grow 6% a year from 2004 to 2008 and 4% a year after that. The firm is expected to finance 10% of its capital expenditures and working capital needs with debt. Dinex Ltd had a beta of 1.20 in 2003, and this beta is expected to drop to 1.10 after 2008. The current risk free rate is 7%.

Estimate the value per share today, based upon the FCFE model.

Section B (2 Mark)

Mr. Nimesh is bullish about ABC Ltd stock. He buys ABC Ltd. at current market price of Rs. 4000 on 4 July. To protect against fall in the price of ABC Ltd. (his risk), he buys an ABC Ltd. Put option with a strike price Rs.3900 (OTM) at a premium of Rs. 143.80 expiring on 31st July.

What would be the Pay-off of the strategy if the stock closes on 4200 at expiry?

Section B (2 Mark)

Which of the following statements concerning index funds and actively managed funds is true?

Section A (1 Mark)

Acquiring the Right Customers, based on known characteristics, which drives growth and increased profit margin, is a benefit of __________

Section B (2 Mark)

A hedge fund manager purchases 10 convertible bonds with a par value of $1,000, a coupon of 7.5%, and a market price of $900. The conversion ratio for the bonds is 20. The conversion ratio is based on the current price of the underlying stock, $45, and the current price of the convertible bond. The delta, or hedge ratio, for the bonds is 0.4.

Therefore, to hedge the equity exposure in the convertible bond, the hedge fund manager must short the following shares of underlying stock:

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the retirement corpus required by Raman to generate his post-retirement expenses.

Section B (2 Mark)

Mansi needs Rs. 25,000/-, 5 years from now. She would like to make equal payments at the Begin of each year from now onwards into an account that yields annual ROI @ 7 % per annum. What should be her annual payments?

Section B (2 Mark)

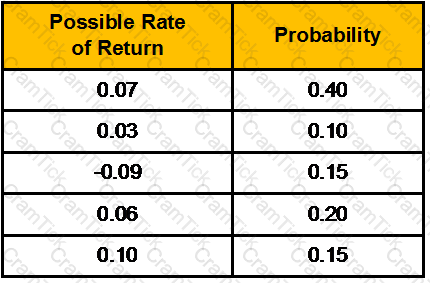

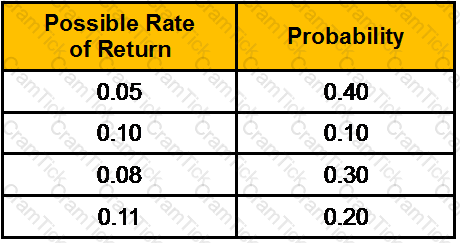

Manish is thinking of acquiring some shares of ABC. Ltd. The rate of returns is as follows:

Calculate the variance and the standard deviation

Section B (2 Mark)

An assessee was allowed deduction of unrealized rent to the extent of Rs. 40,000 in the past although the total unrealized rent was Rs. 60,000. He is able to recover from the tenant Rs.45,000 during the previous year on account of such unrealized rent. He shall be liable to tax to the extent of:

Section B (2 Mark)

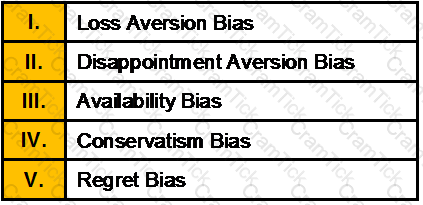

Which of the following Biases are exhibited by Independent Individualist?

Section A (1 Mark)

The profits of a controlled foreign company which are apportioned to a UK company are charged to corporation tax at the UK company's average rate of tax.

Section B (2 Mark)

Select the CORRECT statement regarding basis risk associated with futures.

Section C (4 Mark)

Allianz is a number one accredited institute for the Engineering in New Delhi. It pays dividend per share of Rs. 0.24 on reported earning per share of Rs. 0.512 in 2007. The firms earnings per share have grown at 8% over the prior 5 year but that growth rate is expected to decline linearly over the next 5 years to 3%, while the payout ratio remains unchanged. The beta for the stock is 0.9. The risk free rate is 4.2% and the market risk premium is 4%.Calculate the price of the stock.

Section C (4 Mark)

NCH Corporation, which markets cleaning chemicals, insecticides and other products, paid dividends of Rs2.00 per share in 1993 on earnings of Rs4.00 per share. The book value of equity per share was Rs40.00, and earnings are expected to grow 6% a year in the long term. The stock has a beta of 0.85, and sells for Rs60 per share. (The treasury bond rate is 7%.)

Based upon these inputs, estimate the price/book value ratio for NCH and How much would the return on equity have to increase to justify the price/book value ratio at which NCH sells for currently?

Section C (4 Mark)

You are considering adding a new product to your firm's existing product line. It should cause a 15 percent increase in your profit margin (i.e., new PM = old PM x 1.15), but it will also require a 50 percent increase in total assets (i.e., new TA = old TA x 1.5). You expect to finance this asset growth entirely by debt. If the following ratios were computed before the change, what will be the new ROE if the new product is added and sales remain constant?

Section A (1 Mark)

_______________ is concerned with capturing, storing, extracting, integrating, processing, interpreting, distributing, using and reporting customer-related data to enhance both customer and company value.

Section A (1 Mark)

Which one of the following equations correctly defines the dividend yield (Y) from a share of common stock?

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Bhatia is interested to invest in a mutual fund SIP account and expecting which will grow by atleast 12% for Neena’s education need. Calculate how much he has to deposit per month?

Section C (4 Mark)

Ramesh aged 50 could not save for his retirement till date but now decides to save Rs. 50000 per month till his retirement age of 65. He anticipates that the return in the first 5 years would be 13% p.a. next 5 years 10% and in the last 5 years 8% p.a. He wants to accumulate a corpus of Rs. 1.50 Crores till his retirement. Calculate the surplus or shortfall he would have on his retirement.

Section A (1 Mark)

In reality, when risk and uncertainty or incomplete information about an alternative or high degree of complexity is introduced, people or organizations may be have somewhat different from rationality. This is called ___________.

Section C (4 Mark)

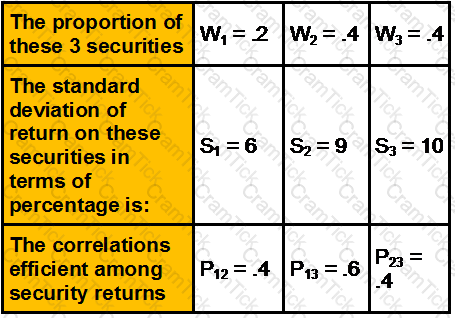

A portfolio consists of 3 securities.

What is the standard deviation of the portfolio?

Section A (1 Mark)

A bank is considering making a loan to Jitesh Desai. Jitesh is a commissioned sales broker. Some months he earns as much as Rs 1,00,000 and in other months he earns virtually nothing. Which aspect of evaluating a consumer loan would this be concerned with?

Section B (2 Mark)

Reproduction cost has been estimated as Rs 350,000 for a property with a 70-year economic life. The current effective age of the property is 15 years. The value of the land is estimated to be Rs 55,000. What is the estimated market value of the property using the cost approach, assuming no external or functional obsolescence?

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable income is:

• $42000 in SGD and he is a Singapore citizen

• £35500 p.a (only employment)and he is a UK citizen

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $ 85650 in US dollars and he is a US citizen (single individual)

• $ 159000 in SGD and he is a citizen of Singapore

Section A (1 Mark)

Mr. Naresh is working in a reputed company and earning Rs. 5,00,000/- p.a. and is now 50 years old. He has invested Rs. 2,50,000/- in an annuity which will pay him after 5 years a certain amount p.a. at the end of every year for 10 years. Rate of interest is 8% p.a. Calculate how much he will receive at the end of every year after 5 years?

Section B (2 Mark)

To pay for new equipment with a cash price of Rs7500, you need to borrow at 5.3% compounded monthly, then make monthly payments for 32 months. How much less would your payments be if you were able to save Rs2100 as a down payment before you purchase the new equipment?

Section A (1 Mark)

As per ARTICLE 12 in DTTA with US , the maximum tax rate on the gross amount of the royalties or fees for included services in the Article is:

Section B (2 Mark)

The expected market return is 16 percent. The risk-free rate of return is 7 percent, and BC Co. has a beta of 1.1. Their required rate of return is

Section C (4 Mark)

Medicon is one the world's largest manufacturer of implantable biomedical devices, reported earnings per share in 1993 of Rs3.95, and paid dividends per share of Rs0.68. Its earnings are expected to grow 16% from 1994 to 1998, but the growth rate is expected to decline each year after that to a stable growth rate of 6% in 2003. The payout ratio is expected to remain unchanged from 1994 to 1998, after which it will increase each year to reach 60% in steady state. The stock is expected to have a beta of 1.25 from 1994 to 1998, after which the beta will decline each year to reach 1.00 by the time the firm becomes stable. (The Risk Free rate is 6.25%.)

Estimate the value per share, using the three-stage dividend discount model.

Section B (2 Mark)

Investors will choose investments that resonate with their own personality or that have characteristics that investors can relate to their own behavior. Taking the opposite view, investors ignore potentially good investments because they can’t relate to or do not come in contact with characteristics of those investments. For example, thrifty people may not relate to expensive stocks (high price/earnings multiples) and potentially miss out on the benefits of owning these stocks.

Which of the following Availability Bias have been exhibited in the case above?

Section B (2 Mark)

Consider a one-year maturity call option and a one-year put option on the same stock, both with striking price Rs100. If the risk-free rate is 5%, the stock price is Rs103, and the put sells for Rs7.50, what should be the price of the call?

Section A (1 Mark)

Financial Gerontology tries to assess client needs based on __________

Section C (4 Mark)

Read the senario and answer to the question.

Nimita wants to know if she were to meet with an accident and get permanent disability in the third year of her Term Insurance policy, what amount of the premium due in the fourth year would be payable by her if the premium being paid towards the policy is Rs. 15,000 with sum assured of Rs. 50 lakh?

Section B (2 Mark)

Retiring early will ____________ the accumulation phase while ____________ the retirement phase

Section A (1 Mark)

With the______________, the buyer gets no protection from encumbrances. This deed type has very specialized uses.

Section B (2 Mark)

Mr. Gupta has got his stock insured against fire for Rs5,00,000/- ,during the year he lost the stock in his ware house for Rs. 4,00,000/-. The surveyor from insurance company gave his report that at the time of fire the stock in the ware house had value 6,00,000/-

Calculate what amount Mr. Gupta will receive from the insurance company.

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Royalties in UK is charged at:

Section B (2 Mark)

Regular collateralized debt obligations (CDO) have been surpassed by:

Section B (2 Mark)

Number One Flight Stock currently sells for Rs53. A one-year call option with strike price of Rs58 sells for Rs10, and the risk free interest rate is 5.5%. What is the price of a one-year put with strike price of Rs58?

Section A (1 Mark)

Why have consumers/customers been so hyper-aware and so nervous?

Section B (2 Mark)

As per Article 11 double Taxation Avoidance Agreement with US Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State.However, such interest may also be taxed in the Contracting State in which it arises, and according to the laws of that State, but if the beneficial owner of the interest is a resident of the other Contracting State, the tax so charged shall not exceed:

(a) ____per cent of the gross amount of the interest if such interest is paid on a loan granted by a bank carrying on a bona fide banking business or by a similar financial institution (including an insurance company); and

(b) _____ per cent of the gross amount of the interest in all other cases.

Section A (1 Mark)

Rapid accumulation stage suggests that the net worth is ________

Section A (1 Mark)

A cognitive heuristic in which decisions are made based on how representative a given individual case appears to be independent of other information about its actual likelihood. We tend to think that trends we observe are likely to continue. Which of the following is most likely consistent with this bias?

Section A (1 Mark)

A type of investor who is willing to risk his own capital and give up security to gain wealth is known as:

Section B (2 Mark)

Compulsory maintenance of account is required u/s 44AA of IT, if the gross receipt/ total sales exceed _______

Section C (4 Mark)

Read the senario and answer to the question.

Calculate the Net Worth of Mr. Adhikari as on 31/03/2009.

Section B (2 Mark)

Mr. Patel expects the stock of A to sell for Rs. 70/- a year from now and to pay Rs. 4/- dividend. If the stock’s correlation with the Market is –0.3, and the standard deviation of A is 40% and standard deviation of the Market is 20% and the risk free rate of return is 5% and the market risk premium is 5%, what would be the price of stock A be now ?

Section C (4 Mark)

Mudra Financial is a large financial firm which owns several mutual funds. The funds are managed individually by portfolio managers but it has an investment committee that overseas all of the funds. This committee is responsible for evaluating the performance of the funds relative to the appropriate benchmark and relative to stated investment objectives of each individual fund. During a recent investment committee meeting, the poor performance of Its Equity Funds were discussed. In particular, the inability of the portfolio managers to outperform their benchmarks was highlighted. The net conclusion of the committee was to review the performance of the manager responsible for each fund and dismiss those managers whose performance had lagged substantially behind the appropriate benchmark.

The fund with the worst relative performance is the Mudra Large Cap Fund which invests in large cap stocks. A review of the operations of the fund found the following:

• The turnover of the fund was almost double that of other similar style mutual funds

• The fund’s portfolio manager solicited input from her entire staff prior to making any decision to sell an existing holding

• The beta of the Mudra Large Cap Fund’s portfolio was 65% higher than the beta of other similar style mutual funds

• The portfolio manager refuses to increase the Capital Goods sector weighting because of past losses the fund incurred in the sector

• The portfolio manager sold all the fund’s Oil Marketing Companies stocks as the price per barrel of oil rose above $105. He expects oil prices to fall back to the $80 to $85 per barrel

• No stock is considered for purchase in the Large Cap Fund unless the portfolio manager has 10 years of financial information on that company.

The underweighting of the Capital Goods sector and selling off Oil Marketing Stocks could be best described as an example of:

Section C (4 Mark)

Maxis Ltd reported Earnings Per Share of Rs 2.10 in 1993, on which it paid dividends per share of Rs 0.69. Earnings are expected to grow 15% a year from 1994 to 1998, during which period the dividend payout ratio is expected to remain unchanged. After 1998, the earnings growth rate is expected to drop to a stable 6%, and the payout ratio is expected to increase to 65% of earnings. The firm has a beta of 1.40 currently, and it is expected to have a beta of 1.10 after 1998. The Risk Free Rate of Return is 6.25%.

What is the value of the stock, using the two-stage dividend discount model?

Section A (1 Mark)

An insured becomes entitled for getting No Claim Bonus only at the renewal of a policy after the expiry of the full duration of _________ months.

Section B (2 Mark)

The risk-free return is 9 percent and the expected return on a market portfolio is 12 percent. If the required return on a stock is 14 percent, what is its beta?

Section A (1 Mark)

investment plan pays Rs. 1 lac at the beginning of 10th year for 5 years and Rs. 2 lacs for next 5 years. If the rate of interest is 10% per annum. What will be the present value of this investment?

Section C (4 Mark)

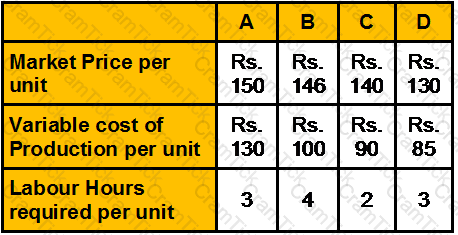

Division Z is a profit centre, which produces four products A, B, C and D, Each product is sold in the external market also. Date for the period is as follows:

Product D can be transferred to division Y but the maximum quantity that might be required for transfer is 2,500 units of D.

The maximum sales in the external market are:

Division Y can purchase the same product at a slightly cheaper price of Rs. 125 per unit instead of receiving transfer of product D from division Z.

What should be transfer price for each unit for 2500 units of D, if the total labour hours available in division Z is:

Section C (4 Mark)

Mr. Dinesh constructs a BULL Call Spread Strategy with one Nifty Call Option having a Strike price of Rs. 4100 available at a premium of Rs. 170.45 and another Nifty Call option with a strike price Rs. 4400 at a premium of Rs. 35.40.

The Net Payoff of BULL Call Spread Strategy

• If Nifty closes at 4300

• If Nifty closes at 3700

Section B (2 Mark)

As per article 11 Double Taxation Avoidance Agreement with UAE, Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State. However, such interest may be taxed in the Contracting State in which it arises and according to the laws of that State, but if the recipient is the beneficial owner of the interest, the tax so charged shall not exceed:

(a) _______ percent of the gross amount of the interest if such interest is paid on a loan granted by a bank carrying on a bona fide banking business or by a similar financial institution; and

(b) _______ percent of the gross amount of the interest in all other cases.

Section A (1 Mark)

Statman (1977) argues that ________ is consistent with some investors' irrational preference for stocks with high cash dividends and with a tendency to hold losing positions too long.

Section B (2 Mark)

A bank recently loaned you Rs15,000 to buy a car. The loan is for five years (60 months) and is fully amortized. The nominal rate on the loan is 12 percent, and payments are made at the end of each month. What will be the remaining balance on the loan after you make the 30th payment?

Section C (4 Mark)

Pacific Asia reported net income of Rs770 million in 1993, after interest expenses of Rs320 million. (The corporate tax rate was 36%.) It reported depreciation of Rs960 million in that year, and capital spending was Rs1.2 billion. The firm also had Rs4 billion in debt outstanding on the books, rated AA (carrying a yield to maturity of 8%), trading at par (up from Rs3.8 billion at the end of 1992). The beta of the stock is 1.05, and there were 200 million shares outstanding (trading at Rs60 per share), with a book value of Rs5 billion. Pacific Asia paid 40% of its earnings as dividends and working capital requirements are negligible. (The Risk Free rate is 7%.)

Estimate the free cash flow to the firm in 1993.

Section A (1 Mark)

____________ is defined as a dollar per thousand dollars of assessed value of property and is used to calculate a property owner's tax bill.

Section B (2 Mark)

An analyst expects a firm’s earning per share to grow at 8% per year. If the firm now earns Rs. 3.50 a share, its earnings per share five years from now are expected to be:

Section B (2 Mark)

After making an investment, assume that an investor overhears a news report that has negative implications regarding the potential outcome of the investment he has just executed. How likely is he to then seek information, if he exhibits self attribution bias, that could confirm that you’ve made a bad decision?

Section A (1 Mark)

Aditya’s father has given him general power of attorney what does this mean?

Section A (1 Mark)

A Wealth Management model in which private client and Institutional Asset Management are kept entirely separate is known as

Section C (4 Mark)

Read the senario and answer to the question.

You advise Sajan to accumulate a retirement corpus at the age of 58 years to sustain 70% of pre-retirement household expenses till his lifetime, and thereafter 50% of pre-retirement expenses till Jennifer’s expected life (instead of Stephanie’s life). Such corpus shall generate an inflation linked monthly outflows, if invested in risk free instruments. He would accumulate at least Rs. 70 lakh for the corpus through his PPF A/C. by suitably investing in the scheme and extending the account till his retirement. For the balance amount of corpus, he wishes to start a monthly SIP immediately in his existing Balanced MF scheme. You calculate such amount to be _________.

Section A (1 Mark)

Pure premium and Loss Ratio methods are two methods to determine

Section B (2 Mark)

Why tilting your portfolio towards growth stocks, may theoretically amplify its performance?

Section A (1 Mark)

_______________ consists of the constatation that people buy both insurances and lottery tickets .

Section C (4 Mark)

Shikha has an investment portfolio of Rs.100000, a floor of Rs.75000, and a multiplier of 2. So the initial portfolio mix is 50000 in stocks and 50000 in bonds. If stock market goes up by 20%, what should Shikha do?

Section A (1 Mark)

If the intrinsic value of a stock is greater than market value, which of the following is a reasonable conclusion?

Section A (1 Mark)

In order to have confirmation of a major market trend under the Dow Theory, the

Section A (1 Mark)

A type of lease where there is no payment schedule and penalty for a set period of lines.

Section C (4 Mark)

Read the senario and answer to the question.

What amount he would have piled up at the end of the 20 years if it earns 8.5% compounded interest and discontinues making deposits after 9th deposit?

Section B (2 Mark)

If a portfolio manager has a good ability to select undervalued securities but a poor ability to forecast overall market, the following makes sense for him:

Section A (1 Mark)

_____________is a percentage of the original or proposed loan to the value of a property.

Section C (4 Mark)

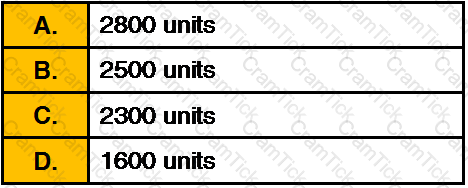

Keshav and Deepti Gohlyan approached you a Chartered Wealth Manager for preparing a Wealth plan to achieve their financial goals. Keshav Gohlyan, aged 45 years, is working in Chennai in an MNC, at a managerial level. His wife Deepti, aged 42 years, is working in a Private Company and has a post-tax income of Rs. 4 lakh p.a. She is expected to retire at the age of 55 years. Keshav’s gross salary is likely to grow at 7% p.a. and Deepti's gross salary is likely to grow at 6% p.a. The couple has two children – daughter Yogita, aged 18 years, pursuing her Graduation in Economics, and son Navneet, aged 16 years, studying in 12th standard. Navneet intends to become a Doctor.

Keshav's monthly household expenses are Rs. 40,000 out of which Rs. 8,000 is of Keshav’s personal expenses, this excludes EMI on loans and Insurance premiums. Keshav has two siblings Keshav and his family stay with his mother. His father passed away due to severe heart attack on 15-Dec-2009, at the age of 75 years, leaving a house (Value on 15thDec 2009 Rs. 25 lakh) in which they are currently staying.

Keshav has a term insurance of Rs. 20 lakh (for 20 years); the term expires 5 years from now. Both are covered under Group Medical Insurance for Rs. 4 Lakh family floater each provided by their respective employers

Assets

The couple’s assets as on 31-3-2010 are;

1.Cash in Hand Rs. 10,000

2.Bank balance Rs. 50,000

3.Diversified Equity Mutual Fund units at market value Rs. 2.60 lakh

4.Equity Shares at market value Rs. 15.25 lakh

5.Debt oriented Mutual Fund units at market value Rs. 1.65 lakh

6.PPF A/c balance Rs. 4.25 lakh (Keshav), Rs. 3.15 lakh (Deepti), both maturing on1st April 2016

7.ELSS Mutual Fund units at market value Rs. 75,000

8.A separate house is in the joint name of Keshav and Deepti with 50% ownership of each. This house has two floors and is let out for rent of Rs. 8,000 p.m. each floor.

Present Market Value of this House is Rs. 70 Lakh1

9.Gold Ornaments at market value Rs. 6.35 lakh

10.Car at market value Rs. 2.60 lakh

11.300 Gold ETF units purchased on 17th Oct 2006 @ 983 per unit

12.National Saving Certificates invested amount Rs. 4 lakh

13.Money back insurance plan of 20 year term with sum assured of Rs. 5 Lakh2

14.Unit linked insurance plan of 10 years with sum assured of Rs. 5 lakh3

____________________

1.Keshav and Deepti had jointly taken a housing loan of Rs. 30 Lakh to purchase the house costing Rs. 37.50 Lakh on 1st April 2003. The pay an EMI of Rs. 16,349 each, EMI date being last day of the month. The loan is for 15 years at a fixed rate of interest of 10.25%p.a.

2.Annual premium of Rs. 23,750. Paid 16 annual premiums till date before due date. The policy provides 25% of basic sum assured to insured as survival benefit after 5th, 10th, 15thyears from the start of the policy.

3.Annual premium of Rs. 35,000 p.a.

Liabilities

Housing loan outstanding: Rs. 21.36 Lakh

Goals & Aspirations:-

1.Plan for Navneet’s medical education expenses which is likely to be Rs. 3.50 lakh at theend of one year from now and increasing thereafter at 8%p.a. during the next 4years.

2.Plan for Yogita’s goal of Post-Graduation degree from abroad which is likely to cost Rs. 10 lakh in present terms required after three years.

3.Create a separate fund to provide every year post-retirement till his lifetime, vacation expenses amounting to Rs. 50,000 in current terms, such expenses increasing at the rate of 7% p.a.

4.To accumulate funds for marriage of Navneet and Yogita. For Navneet they will require in present terms Rs. 10 lakh when he attains 26 years and for Yogita he would require Rs. 15 lakh when she attains 25 years.

5.Build a retirement corpus for expenses in his post-retirement period at 75% of pre-retirement expenses at the retirement age of 60 years

Life Expectancy

Keshav: 80 years

Deepti: 78 years

Assumptions regarding long-term pre-tax returns on various asset classes:

1.Equity & Equity MF schemes/ Index ETFs11.00% p.a.

2.Balanced MF schemes9.00% p.a.

3.Bonds/Govt. Securities/Debt MF schemes7.00% p.a.

4.Liquid MF schemes5.50% p.a.

5.Gold & Gold ETF7.50% p.a.

Assumptions regarding economic factors:

1.Inflation: 5.50% p.a.

2.Expected return in Risk free instruments: 6.50% p.a.

3.Real Estate appreciation: 8.00% p.a

Cost Inflation Index

Section A (1 Mark)

A bank is considering making a loan to Sumit Nayyar. Mr. Sumit has Rs 1,00,000 in the bank right now but generally keeps a balance of Rs 4,50,000 most of the year. What aspect of evaluating a consumer loan application is this fact concerned with?

Section A (1 Mark)

Which of the following is allowed as deduction from net annual value of a property?

Section B (2 Mark)

How much should one deposit today in a bank account paying interest compounded quarterly if you wish to have Rs. 10000 at the end of 3 months, if the bank pays 5% annually?

Section A (1 Mark)

A bank that wants to protect itself from higher credit costs due to a decrease in its credit rating might purchase _________________________.

Section C (4 Mark)

National City Corporation, a bank holding company, reported earnings per share of Rs2.40 in 1993, and paid dividends per share of Rs1.06. The earnings had grown 7.5% a year over the prior five years, and were expected to grow 6% a year in the long term (starting in 1994). The stock had a beta of 1.05 and traded for ten times earnings. The treasury bond rate was 7%.

Estimate the P/E Ratio for National City Corporation and the long term growth rate that is implied in the firm's current P/E ratio.

Section A (1 Mark)

Which of the following is the process of enabling personnel to deliver service in manner that is beneficial to both the organization’s customers and to itself?

Section B (2 Mark)

Which of the following statements with respect to International Taxation Structure is/are correct?

Section A (1 Mark)

Supporting customers through the process of selecting, purchasing, and maintaining a product or service is known as:

Section B (2 Mark)

Suppose the price of a share of CAS stock is Rs500. An April call option on CAS stock has a premium of Rs5 and an exercise price of Rs500. Ignoring commissions, the holder of the call option will earn a profit if the price of the share

Section A (1 Mark)

Which of the following is not an essential element of a trust?

Section A (1 Mark)

A ____________________ tax system takes the same percentage of each person's income, regardless of whether the income is high, medium, or low.

Section B (2 Mark)

Shiva Industries Ltd. earns Rs. 2 per share and distributes 40% of its earnings as cash dividends. Its dividends grew annually at 7%. What will be the stock’s price if the required rate is 10%?

Section A (1 Mark)

The difference between the cash price and the futures price on the same asset or commodity is known as the

Section C (4 Mark)

Read the senario and answer to the question.

Saxena wants to know his income tax liability for FY 2007–08 without taking into consideration any interest income from NSC. Calculate the same including surcharge and Educational Cess.

Section C (4 Mark)

J&M had a return on equity of 31.5% in 1993, and paid out 37% of its earnings as dividends. The stock had a beta of 1.25. (The treasury bill rate is 6%.) The extraordinary growth is expected to last for ten years, after which the growth rate is expected to drop to 6% and the return on equity to 15% (the beta will move to 1).

Assuming the return on equity and dividend payout ratio continue at current levels for the high growth period, estimate the P/BV ratio for J&M.

Section A (1 Mark)

Commodity exchanges enable producers and consumer to hedge their _______ given the uncertainty of the future.

Section B (2 Mark)

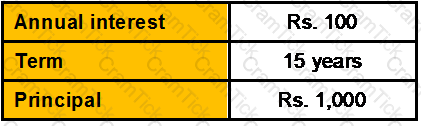

A bond has the following terms:

If you expect the bond to be called at the end of the year, what would be the maximum price you should pay for the bond if comparable yields are 7 percent?

Section A (1 Mark)

A relatively new type of credit derivative is a CDO which stands for ________________.

Section A (1 Mark)

____________ may be responsible for the prevalence of active versus passive investments management.

Section A (1 Mark)

What is the Present Value of an annuity which pays Rs. 10,000/- for 3 years at the END of each year, assuming ROI @ 7% per annum compounded annually?

Section B (2 Mark)

Compute YTM of a bond with par value of Rs.1000/-, carrying a coupon rate of 8% and maturing after 10 years. The bond is currently selling for Rs.850/-.

Section A (1 Mark)

The proposed Fair Tax would change the U.S. tax system and instead:

Section C (4 Mark)

Mr. XYZ sells a Nifty Put option with a strike price of Rs. 4000 at a premium of Rs. 21.45 and buys a further OTM Nifty Put option with a strike price Rs. 3800 at a premium of Rs. 3.00 when the current Nifty is at 4191.10, with both options expiring on 31st July.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3980.55

• If Nifty closes at 4800

Section A (1 Mark)

Mr. Sharma is aged 50 years at present. He has invested some amount in an annuity which will pay him after 10 years Rs. 25,000/- p.a. at the beginning of every year for 10 years. Rate of interest is 6% p.a. Calculate how much amount he has invested now?

Section A (1 Mark)

You have added more money to a losing stock twice, despite no good news about the stock. You are likely demonstrating which type of judgment error?

Section A (1 Mark)

Which of the Following needs to register as an' Investment Adviser' as per SEBI Investment Advisor Regulations 2013.

Section B (2 Mark)

How much loan can be given from PPF account in the year 2006-07?

Section C (4 Mark)

Find out the effective quarterly rate for 18% per annum compounded half yearly.

Section A (1 Mark)

Quicker attention and resolution of complaints lead to ________

Section B (2 Mark)

Mrs. Sharma, a 40-year-old widow, has an 8-year-old son. Her current savings are not adequate to provide for her son’s post graduate studies, however she will be able to save for it by the time he finishes graduation i.e. when he is 20 years old. Mortality tables indicate that her life expectancy is another 30 years.

Which one of the following is true?

Section A (1 Mark)

A cognitive heuristic in which decisions are made based on an initial 'anchor__________

Section C (4 Mark)

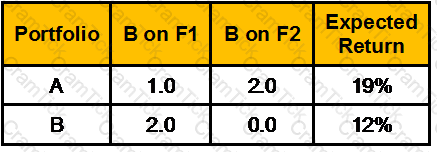

Consider the multifactor APT. There are two independent economic factors, F1 and F2. The risk-free rate of return is 6%. The following information is available about two well-diversified portfolios:

Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolio should be __________.

Section C (4 Mark)

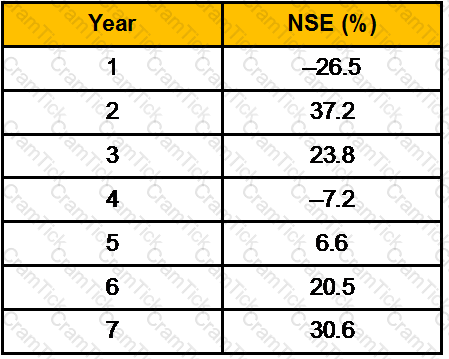

You are given the following set of data:

Historical Rate of Return

Determine the arithmetic average rates of return and standard deviation of returns of the NSE over the period given.

Section A (1 Mark)

Depending on how questions are asked, ___________ can cause investors to communicate responses to questions about risk tolerance that are either unduly conservative or unduly aggressive.

Section A (1 Mark)

Dividend received by a shareholder from an Indian company the whole of whose income is agricultural income shall be treated as:

Section A (1 Mark)

Which of the following is a risk of using credit derivatives?

Section C (4 Mark)

Suppose Sunil visits his favorite coffee shop and encounters his good friend Rohit. Rohit raves about his stockbroker, whose firm employs an analyst who appears to have made many recent successful stock picks. The conversation goes something like this:

SUNIL: Hi, Rohit, how are you?

ROHIT: Hi, Sunil. I’m doing great! I’ve been doing superbly in the market recently.

SUNIL: Really? What’s your secret?

ROHIT: Well, my broker has passed along some great picks made by an analyst at her firm.

SUNIL: Wow, how many of these tips have you gotten?

ROHIT: My broker gave me three great stock picks over the past month or so. Each stock is up now, by over 10 percent.

SUNIL: That’s a great record. My broker seems to give me one bad pick for every good one. It sounds like I need to talk to your broker; she has a much better record!

Which of the following biases have been exhibited by Gaurav?

Section A (1 Mark)

____________is the reasonably probable and legal use of vacant land or an improved property that is physically possible, legally permissible, appropriately supported, financially feasible, and that results in the highest value.

Section A (1 Mark)

Total current assets of a company are Rs.960 lakh while the current liabilities (other than bank borrowings) are Rs.300 lakh. If the company borrowed Rs.350 lakh, what will be the amounts of Maximum Permissible Bank Finance (MPBF) under the (method I) of the Tandon committee recommendations?

Section A (1 Mark)

Who would get the first preference when the property of a deceased person is to be distributed?

Section A (1 Mark)

The investors who buy the debt of troubled companies including subordinated debt, junk bonds, bank loans, and obligations to suppliers are called__________

Section A (1 Mark)

___________ is a measure of the ratio between the net income produced by an assets (usually real estate) and its capital cost.

Section A (1 Mark)

Manish is thinking of acquiring some shares of ABC Ltd. The rate of returns is as follows:

Calculate the expected return on the investments

Section A (1 Mark)

Mr. Rajesh was the owner of an uninsured property. But unfortunately the property caught fire because of which he suffered severe financial losses. The reason Mr. Rajesh suffered losses as he did not cover:

Section B (2 Mark)

Last year, Owen Technologies reported negative net cash flow and negative free cash flow. However, its cash on the balance sheet increased. Which of the following could explain these changes in its cash position?

Section A (1 Mark)

An option which gives the holder the right to sell a stock at a specified price at some time in the future is called a

Section A (1 Mark)

Adjusted gross income is used in establishing limits on the following deductions, with the exception of

Chartered Wealth Manager | CWM_LEVEL_2 Questions Answers | CWM_LEVEL_2 Test Prep | Chartered Wealth Manager (CWM) Certification Level II Examination Questions PDF | CWM_LEVEL_2 Online Exam | CWM_LEVEL_2 Practice Test | CWM_LEVEL_2 PDF | CWM_LEVEL_2 Test Questions | CWM_LEVEL_2 Study Material | CWM_LEVEL_2 Exam Preparation | CWM_LEVEL_2 Valid Dumps | CWM_LEVEL_2 Real Questions | Chartered Wealth Manager CWM_LEVEL_2 Exam Questions